How Present Value and WACC Transform IP Valuation

In the complex world of intellectual property👉 Creations of the mind protected by legal rights. (IP) valuation, the income approach using discounted cash flow (DCF) method stands out as a powerful tool for assessing the worth of intangible assets. At the heart of this method lies the concept of net present value (NPV) calculation, which, when combined with the weighted average cost of capital (WACC), elevates the valuation process from a mere mathematical exercise to a nuanced assessment of an asset’s true value. This essay explains the intricacies of NPV calculation, its application in IP valuation through the income approach, and how the introduction of WACC transforms the process into a comprehensive valuation beyond simple arithmetic.

Ishii, Yasuyuki: Valuation of Intellectual Property, Japan Patent👉 A legal right granting exclusive control over an invention for a limited time. Office, Asia-Pacific Industrial Property Center, Tokyo: 2017

Drews, David: Ten Common Mistakes in IP Valuation/Demage Reports, les Nouvelles 7 (2016)

Brassell, Martin; Maguire, Jackie: Appendix UK IP Valuation Methodology, report commissioned by the UK IP Office, Swansea, UK: 2017

Understanding Net Present Value (NPV)

Net Present Value is a fundamental concept in finance that allows us to determine the current worth of a series of future cash flows. The principle behind NPV is straightforward: money today is worth more than the same amount of money in the future due to its potential earning capacity and the effects of inflation. This concept, known as the time value of money, is crucial in valuing any asset, especially intangible ones like intellectual property.

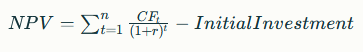

The NPV calculation involves estimating future cash flows an asset will generate and then discounting these cash flows back to their present value using an appropriate discount rate. The formula for NPV is:

Where:

- CFt represents the cash flow at time t

- r is the discount rate

- n is the number of periods

If the resulting NPV is positive, it indicates that the investment is potentially profitable, while a negative NPV suggests that the investment may result in a net loss.

Applying NPV in IP Valuation: The Income Approach

The income approach to IP valuation is based on the principle that an asset’s value is derived from its ability to generate future economic benefits. In the context of intellectual property, these benefits are typically in the form of cash flows. The discounted cash flow method, a specific application of the income approach, uses NPV calculations to determine the present value of these future cash flows.

When applying the DCF method to IP valuation, several key steps are involved:

- Estimating Future Cash Flows

This involves projecting the revenue and costs associated with the IP asset over its expected economic life. For patents, this might include licensing👉 Permission to use a right or asset granted by its owner. fees or increased sales of patented products. For trademarks, it could be the premium pricing or increased market share attributable to the brand👉 A distinctive identity that differentiates a product, service, or entity.. - Determining the Discount Rate

The discount rate used in IP valuation should reflect the risk👉 The probability of adverse outcomes due to uncertainty in future events. associated with realizing the projected cash flows. This is where the concept of WACC becomes crucial, which we’ll explore in more depth later. - Calculating Present Value

Once the future cash flows and discount rate are established, the NPV calculation is performed to determine the present value of these cash flows. - Assessing Economic Life

Unlike tangible assets, IP often has a finite economic life, which must be factored into the valuation. This could be the remaining life of a patent or the period over which a trademark👉 A distinctive sign identifying goods or services from a specific source. is expected to generate value. - Considering Risks and Uncertainties

IP valuation must account for various risks, including technological obsolescence, legal challenges, and market adoption. These factors can significantly impact the projected cash flows and the appropriate discount rate.

The Role of WACC in IP Valuation

The Weighted Average Cost of Capital (WACC) is a critical component in the DCF method of IP valuation. WACC represents the average rate of return a company is expected to pay to its security holders to finance its assets. It combines the cost of equity and the cost of debt, weighted by their proportions in the company’s capital structure.

The formula for WACC is:

![]()

Where:

- E is the market value of equity

- D is the market value of debt

- V is the total market value (E + D)

- Re is the cost of equity

- Rd is the cost of debt

- T is the tax rate

Incorporating WACC into IP valuation transforms the process from a simple calculation into a more comprehensive assessment for several reasons:

- Risk Reflection

WACC captures the overall risk profile of the company owning the IP. However, it’s important to note that IP assets often carry higher risk than the company’s average, necessitating adjustments to the WACC for IP-specific risks. - Market Perspective

By including the cost of both equity and debt, WACC provides a market-based view of the company’s capital structure, which can influence the value of its IP assets. - Time Value of Money

WACC inherently accounts for the time value of money, a crucial concept in NPV calculations. - Company-Specific Factors

The use of WACC allows the valuation to consider company-specific factors that might affect the value of the IP, such as the company’s ability to exploit the asset effectively. - Industry Context

WACC can vary significantly across industries, providing context for the valuation of IP within specific sectors.

Adapting WACC for IP Valuation

While WACC provides a starting point for determining the discount rate in IP valuation, it often requires adjustment to accurately reflect the risk profile of specific IP assets. Intellectual property, particularly early-stage or innovative IP, typically carries higher risk than a company’s overall operations. As a result, the discount rate used for IP valuation is often higher than the company’s WACC.

Some considerations when adapting WACC for IP valuation include:

- Risk Premium

Adding a risk premium to the WACC to account for the higher risk associated with IP assets. This premium can vary based on factors such as the stage of development, market potential, and legal strength of the IP. - Technological Risk

For patents and other technology-based IP, considering the risk of technological obsolescence or the emergence of superior competing technologies. - Market Adoption Risk

Assessing the uncertainty around market acceptance and commercialization of the IP-protected product or service. - Legal Risk

Factoring in the potential for legal challenges, such as patent invalidation or trademark infringement👉 Unauthorized use or exploitation of IP rights. disputes. - Stage of Development

Early-stage IP typically carries higher risk and may require a higher discount rate compared to established, revenue-generating IP.

Beyond Calculation: The Art of IP Valuation

The introduction of WACC and its subsequent adaptation for IP-specific risks elevates the valuation process beyond mere calculation. It requires a deep understanding of both the IP asset and the broader business and market context in which it exists. This holistic approach transforms IP valuation into a nuanced assessment that considers:

- Strategic Value

WACC helps in assessing how the IP fits into the company’s overall strategy and its potential to create competitive advantages. - Synergies

By considering the company’s cost of capital, the valuation can better account for potential synergies between the IP and other company assets. - Growth Potential

The use of WACC allows for a more accurate assessment of how the IP might contribute to the company’s future growth prospects. - Market Dynamics

WACC inherently reflects market expectations and conditions, providing a link between the IP valuation and broader market trends. - Financing Implications

Understanding the company’s cost of capital through WACC provides insights into how the IP might affect future financing decisions.

Challenges and Considerations

While the use of NPV and WACC in IP valuation provides a robust framework, it’s not without challenges:

- Subjectivity

Estimating future cash flows and determining appropriate risk adjustments involve significant judgment and can be subject to bias. - Uncertainty

IP assets, especially innovative ones, often face high levels of uncertainty in terms of future performance and market acceptance. - Data Limitations

Obtaining reliable market data for comparable IP transactions can be challenging, making it difficult to validate valuations. - Dynamic Nature

The value of IP can change rapidly due to technological advancements, market shifts, or legal developments, requiring frequent reassessment. - Intangible Factors

Some aspects of IP value, such as brand loyalty or the potential for future innovations, are difficult to quantify and incorporate into DCF models.

Conclusion

The application of net present value calculations in the income approach to IP valuation, particularly when incorporating and adapting the weighted average cost of capital, represents a sophisticated method for assessing the value of intangible assets. This approach goes beyond simple arithmetic, requiring a deep understanding of finance, market dynamics, and the unique characteristics of intellectual property.

By combining the rigor of NPV calculations with the nuanced insights provided by WACC, valuators can produce more accurate and meaningful assessments of IP value. This comprehensive approach considers not just the potential future cash flows, but also the risks, strategic implications, and market context of the IP asset.

As the global economy continues to shift towards knowledge-based and innovation-driven models, the ability to accurately value intellectual property becomes increasingly crucial. The methods discussed in this essay provide a robust framework for this valuation process, offering insights that are valuable not just for financial reporting, but also for strategic decision-making, mergers and acquisitions, and IP portfolio management👉 Strategic management of diverse assets to optimize returns and balance risk..

In essence, the integration of NPV, DCF, and WACC in IP valuation transforms what could be a purely mathematical exercise into a nuanced art form, blending quantitative analysis with qualitative insights to capture the true value of some of the most important assets in the modern economy.