Mastering WACC for Smarter Asset Pricing

Intellectual Property👉 Creations of the mind protected by legal rights. (IP) valuation is a critical process in today’s knowledge-based economy, where intangible assets often represent significant value for companies. The Weighted Average Cost of Capital (WACC) plays a crucial role in this valuation process, serving as a foundation for determining the appropriate discount rate. However, IP assets typically carry higher risks than tangible assets, necessitating careful adjustments to the WACC.

Royal Institution of Chartered Surveyors (RICS), Valuation of intellectual property rights, RICS professional standard, global, 2nd edition, London: March 2020.

Technical author: Tim Heberden FRICS (Deloitte); Working group: Nova Chan FRICS (PwC); Rene Hlousek MRICS (Beacon Valuation Group LLC); Soo Earn Keoy (Deloitte); Daniel Ryan FRICS (BRG); Paul Simpson FRICS (HMRC); Steven van Wijk MRICS (DVC-International); RICS professional group lead Steve Choi (RICS)

Taggart, Robert A. Jr.: Consistent valuation and cost of capital expressions with corporate and personal taxes, NBER Working Paper Series, Working Paper No. 3074, 08.1989, Cambridge, MA (USA).

How to determine the WACC for IP valuation?

To determine the WACC (Weighted Average Cost of Capital) for IP valuation, you need to adjust the standard WACC calculation to account for the higher risks associated with intellectual property assets. Here’s how to approach this:

Start with the Standard WACC

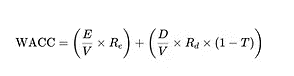

Begin by calculating the company’s overall WACC using the traditional formula:

Where:

- E = Equity market value

- D = Debt market value

- V = Total market value (E + D)

- Re = Cost of equity

- Rd = Cost of debt

- Tc = Corporate tax rate

Adjust for IP-Specific Risks

After calculating the standard WACC, you need to adjust it to reflect the higher risks associated with IP assets:

- Identify IP-Specific Risks: Assess risks unique to the IP, such as technological uncertainty, market adoption, legal challenges, and potential obsolescence.

- Add a Risk👉 The probability of adverse outcomes due to uncertainty in future events. Premium: Increase the discount rate by adding a risk premium to the WACC. The adjusted formula would be:

Adjusted Discount Rate = WACC + Risk Premium

- Determine the Risk Premium: The risk premium can vary significantly based on the specific IP and its associated risks. Typically, discount rates for patent👉 A legal right granting exclusive control over an invention for a limited time. valuations can range from 20% to 40% or even higher.

Consider Alternative Approaches

In some cases, using an adjusted WACC may not be sufficient for IP valuation:

- Build-Up Method: Instead of adjusting the WACC, you might construct a discount rate from the ground up, considering risk-free rates, market risk premiums, and specific risk factors related to the IP.

- Venture Capital Method: For early-stage IP, consider using higher discount rates that reflect the extreme risk and uncertainty, potentially ranging from 40% to 60% or more.

- Comparable Transactions: Look at discount rates used in similar IP transactions in the industry to benchmark your rate.

Example

Let’s say a company has a WACC of 10%, and you’re valuing a patent with significant technological and market risks:

- Standard WACC: 10%

- IP Risk Premium: 15% (based on assessment of specific risks)

- Adjusted Discount Rate: 10% + 15% = 25%

This adjusted rate of 25% would then be used to discount the projected cash flows from the IP asset.

Remember, the key is to ensure that the discount rate accurately reflects the higher risk profile of IP assets compared to the company’s overall risk captured by the standard WACC. The specific adjustment will depend on the unique characteristics and risks of the IP being valued.

How does the WACC differ for IP valuation compared to traditional company valuation?

The WACC (Weighted Average Cost of Capital) for IP valuation differs significantly from traditional company valuation due to the unique characteristics and higher risks associated with intellectual property assets. Here are the key differences:

Higher Risk Premium

Intellectual property (IP) valuation presents unique challenges due to the inherent risks and uncertainties associated with these intangible assets. When using the Weighted Average Cost of Capital (WACC) for IP valuation, two key factors must be considered:

- Increased Uncertainty: IP assets, particularly those in nascent stages or cutting-edge fields, are subject to significantly higher levels of uncertainty compared to established business operations. This uncertainty stems from factors such as unproven market demand, potential technological obsolescence, and the ever-present threat of competitive innovations. Consequently, traditional valuation methods may fall short in accurately capturing the true risk profile of these assets, necessitating a more nuanced approach to risk assessment.

- Risk Adjustment: To account for the elevated risk associated with IP assets, valuators typically apply a substantial risk premium to the standard company WACC when determining the appropriate discount rate for IP valuation. This adjustment often results in discount rates ranging from 20% to 40% or even higher, reflecting the increased volatility and potential for failure inherent in IP investments. The magnitude of this risk premium is carefully calibrated based on factors such as the IP’s stage of development, market potential, and the competitive landscape in which it operates.

Specific Risk Factors

Intellectual property assets are subject to unique risks that set them apart from traditional tangible assets. These specific risk factors must be carefully considered when determining the appropriate WACC for IP valuation:

- Technological Obsolescence: In the rapidly evolving landscape of technology, IP assets face a constant threat of becoming outdated. This risk is particularly acute in fast-moving industries where innovation👉 Practical application of new ideas to create value. cycles are short and disruptive technologies can emerge unexpectedly. Valuators must consider the potential for technological shifts that could render an IP asset less valuable or even obsolete, significantly impacting its long-term worth.

- Legal Risks: The legal landscape surrounding IP assets introduces a layer of complexity not typically encountered in company-wide valuations. Patents and other forms of IP can face challenges from competitors, infringement issues that may require costly litigation, or even the risk of invalidation through legal proceedings. These legal risks can have substantial impacts on the value and future cash flows of IP assets, necessitating careful consideration in the valuation process.

- Market Adoption: The success of an IP asset often hinges on its acceptance and adoption by the market, a factor that can be highly unpredictable. Even technologically superior or legally robust IP may fail to gain traction if it doesn’t meet market needs or face unforeseen adoption barriers. Valuators must assess the potential for market acceptance and the associated risks, which can significantly influence the IP’s future cash flows and overall value.

Cash Flow Patterns

The cash flow patterns associated with IP assets often differ markedly from those of traditional company valuations, introducing unique challenges to the valuation process. Understanding these distinct patterns is crucial for accurate IP valuation:

- Irregular Cash Flows: Unlike company valuations that typically assume stable or steadily growing cash flows, IP assets may generate highly variable or lumpy cash flow projections. These irregular patterns can result from factors such as licensing👉 Permission to use a right or asset granted by its owner. agreements, milestone payments, or market uptake cycles. Valuators must carefully model these potentially erratic cash flows, considering various scenarios and their probabilities to arrive at a realistic valuation.

- Limited Life: Many IP assets, particularly patents, have a finite useful life, in contrast to the going concern assumption often applied in company valuations. This limited lifespan affects both the valuation timeframe and the calculation of terminal values. Valuators must consider the remaining life of the IP, potential extensions or renewals, and the declining value as the IP approaches expiration, all of which impact the overall valuation and the application of WACC.

Industry-Specific Considerations

The valuation of IP assets requires a nuanced understanding of industry-specific factors that can significantly influence the appropriate WACC. These considerations vary widely across different sectors and stages of development:

- Sector Variability: The WACC for IP can fluctuate considerably across different industries due to varying risk profiles and market dynamics. For instance, biotech IP might command a higher WACC compared to consumer goods IP, reflecting the longer development cycles, stringent regulatory requirements, and higher failure rates in the biotech sector. Valuators must carefully analyse industry-specific risks and adjust the WACC accordingly to reflect these sectoral differences.

- Stage of Development: The development stage of an IP asset plays a crucial role in determining its risk profile and, consequently, its WACC. Early-stage IP, which may still be in the conceptual or developmental phase, typically requires a higher WACC due to greater uncertainties surrounding its commercial viability and market potential. In contrast, mature, revenue-generating IP may warrant a lower WACC, reflecting its proven track record and more predictable cash flows.

Valuation Methods

The complexity of IP assets often necessitates a more diverse and sophisticated approach to valuation compared to traditional company valuations. This complexity is reflected in the range of valuation methods employed:

- Multiple Approaches: While company valuations frequently rely on DCF models using WACC, IP valuations often require a broader toolkit. Methods such as real options analysis, which can capture the value of future flexibility, decision tree analysis for mapping out potential outcomes, and comparable transaction multiples for market-based valuations are commonly employed. This multi-faceted approach allows valuators to capture the unique characteristics and potential of IP assets more accurately.

- Scenario Analysis: Given the inherent uncertainties surrounding IP assets, valuations often incorporate extensive scenario modeling. This approach allows for the consideration of various potential outcomes and risk factors, providing a more comprehensive view of the IP’s value under different circumstances. Valuators may develop multiple scenarios, assign probabilities, and calculate weighted average outcomes to arrive at a more robust valuation.

Data Limitations

IP valuation often faces significant challenges due to the limited availability of relevant market data and the unique nature of each IP asset. These data limitations require valuators to employ creative solutions and rely more heavily on judgment and comparable analysis:

- Lack of Market Data: Unlike public companies, IP assets typically lack readily available market data crucial for calculating key WACC components such as beta. This scarcity of data necessitates a more judgmental approach, often relying on proxy data from comparable companies or industries. Valuators must carefully select and adjust these proxies to reflect the specific characteristics of the IP asset being valued, introducing an additional layer of complexity to the WACC determination process.

- Unique Nature: The highly specific nature of many IP assets poses a significant challenge in finding appropriate benchmarks for risk assessment. Each IP asset may have unique technological features, market applications, or legal protections that set it apart from others in its field. This uniqueness makes it difficult to draw direct comparisons or apply standardized risk metrics, requiring valuators to exercise considerable judgment in assessing and quantifying the specific risks associated with each IP asset.

In summary, while the basic WACC formula remains the same, its application in IP valuation requires significant adjustments to account for higher risks, unique cash flow patterns, and the specific nature of intellectual property assets. This typically results in a higher overall discount rate and a more nuanced approach to risk assessment compared to traditional company valuations.

Why is it good practice to let the financial market do the risk assessment using the WACC when valuing IP?

Letting the financial market do the risk assessment using the WACC when valuing IP offers several advantages:

Market Efficiency

The efficiency of financial markets plays a crucial role in determining the accuracy and reliability of WACC for IP valuation. By leveraging market efficiency, valuators can tap into a vast pool of collective knowledge and real-time information:

- Collective Wisdom: Financial markets serve as a melting pot of information, aggregating insights and expectations from a diverse array of market participants. This collective wisdom can lead to more comprehensive and accurate risk assessments, as it incorporates a wide range of perspectives and expertise. By utilizing market-derived WACC, IP valuators can benefit from this aggregated knowledge, potentially capturing risk factors that might be overlooked in individual assessments.

- Real-time Updates: One of the key advantages of market-based risk assessments is their dynamic nature. Market prices and, by extension, market-derived WACC components are continuously updated to reflect the latest information, economic conditions, and market expectations. This real-time adjustment ensures that the WACC used in IP valuation remains current and relevant, capturing the most up-to-date risk perceptions and market sentiments.

Objectivity and Consistency

Utilizing market-derived WACC for IP valuation offers significant benefits in terms of objectivity and consistency. These advantages help to enhance the credibility and comparability of valuations:

- Reduced Bias: Market-based assessments inherently minimize the impact of individual biases or subjective judgments that can often creep into manual risk assessments. By relying on market data, valuators can avoid personal preconceptions or limited perspectives that might skew risk estimations. This reduction in bias leads to more objective and reliable WACC calculations, enhancing the overall quality of IP valuations.

- Standardization: The use of market-derived WACC provides a consistent benchmark across different IP valuations within similar industries or risk categories. This standardization allows for more meaningful comparisons between different IP assets and valuations, enhancing the overall coherence and reliability of the valuation process. It also facilitates better communication of valuation results to stakeholders, as the methodology is based on widely accepted market metrics.

Comprehensive Risk Capture

Market-based WACC calculations offer a comprehensive approach to risk capture, encompassing a wide range of factors that influence asset valuation. This holistic risk assessment is particularly valuable in the complex landscape of IP valuation:

- Broad Risk Factors: Financial markets inherently price in a diverse array of risk factors, including economic, political, and industry-specific risks. This comprehensive risk pricing often captures nuanced factors that might be overlooked in manual assessments, providing a more complete risk profile for IP valuation. The market’s ability to synthesize multiple risk dimensions can lead to a more accurate and holistic risk assessment for IP assets.

- Systematic Risks: Market-based WACC is particularly effective at capturing systematic risks that affect the entire market or industry. These broad-based risks, which can significantly impact IP value, are often difficult to quantify through individual analysis alone. By incorporating market-wide risk perceptions, WACC derived from market data provides a more robust foundation for assessing the overall risk profile of IP assets within their broader economic and industry context.

Practical Advantages

The use of market-derived WACC in IP valuation offers several practical advantages that can enhance the efficiency and credibility of the valuation process. These benefits make market-based approaches particularly attractive in many valuation scenarios:

- Cost-Effective: Relying on market-derived WACC can significantly reduce the time and resources required for IP valuation compared to conducting extensive custom risk assessments for each asset. This cost-effectiveness is particularly valuable when dealing with multiple IP assets or frequent valuations. By leveraging readily available market data, valuators can streamline their processes, allowing for more efficient allocation of resources while maintaining valuation quality.

- Defensibility: Market-based assessments often carry greater weight in legal or regulatory contexts due to their objective and widely accepted nature. The use of market-derived WACC provides a strong foundation for defending valuation results, as it relies on transparent and verifiable data sources. This defensibility can be crucial in situations involving disputes, transactions, or regulatory compliance, where the credibility of the valuation methodology is closely scrutinized.

Limitations to Consider

While market-based WACC offers numerous advantages for IP valuation, it’s crucial to recognize its limitations and potential shortcomings. Understanding these constraints allows valuators to apply market-derived WACC judiciously and supplement it with other methods when necessary:

- Unique IP Characteristics: Market-derived WACC, being based on broader market or industry data, may not fully capture the idiosyncratic risks associated with specific IP assets. Each IP has unique attributes, such as its technological novelty👉 Requirement that an invention must be new and not previously disclosed., potential market disruption, or legal strengths and vulnerabilities, which may not be reflected in general market risk assessments. Valuators must carefully consider these asset-specific factors and potentially adjust the market-derived WACC to account for these unique characteristics, ensuring a more accurate risk profile for the IP in question.

- Market Inefficiencies: While financial markets are generally efficient, they may not always accurately price all risks, particularly for highly specialized or novel IP assets. In cases where the market lacks sufficient information or understanding of an IP’s potential, the resulting WACC may not fully reflect the true risk profile of the asset. This limitation is especially relevant for groundbreaking technologies or IP in emerging fields where market participants may struggle to accurately assess and price associated risks.

- Applicability: For early-stage or highly innovative IP, market-based assessments might have limited relevance due to the scarcity of comparable market data. These assets often operate in uncharted territories, making it challenging to find suitable market benchmarks or risk proxies. In such cases, relying solely on market-derived WACC could lead to misestimation of risks and potentially inaccurate valuations. Valuators may need to complement market-based approaches with alternative methods, such as scenario analysis or real options valuation, to capture the unique risk-return profile of these innovative assets.

In conclusion, while letting the financial market do the risk assessment via WACC is generally a good approach for IP valuation due to its efficiency, objectivity, and comprehensiveness, it should be complemented with careful consideration of IP-specific factors that may not be fully reflected in market-based assessments.

If the IP asset-specific risks can be specifically identified and taken into account in the numerator of the DCF method, what other risks must be taken into account in the WACC?

When using the Discounted Cash Flow (DCF) method for IP valuation, if the IP asset-specific risks are accounted for in the numerator (cash flows), the WACC still needs to reflect certain risks in the denominator (discount rate). The risks that should be considered in the WACC include:

Market and Systematic Risks

Market and systematic risks are broad, pervasive factors that affect the entire economy or specific industries. These risks are crucial to consider in WACC calculations for IP valuation as they can significantly impact the overall risk profile of the asset:

- General Economic Conditions: The overall state of the economy plays a pivotal role in shaping the risk environment for IP assets. Factors such as GDP growth, inflation rates, and interest rates can have far-reaching effects on the value and potential of intellectual property. For instance, during periods of economic growth, IP assets may benefit from increased investment and market opportunities, while economic downturns could lead to reduced demand or funding for innovation.

- Industry-Specific Risks: Each industry faces unique challenges and opportunities that can significantly impact the value of IP assets within that sector. These risks might include regulatory changes, shifts in consumer preferences, or technological disruptions specific to the industry. Valuators must carefully analyse and incorporate these industry-specific risks into the WACC calculation to ensure an accurate reflection of the IP asset’s risk profile within its particular market context.

- Market Volatility: General market fluctuations can affect the perceived value and risk of IP assets, even if these assets are not directly traded in public markets. High market volatility can lead to increased uncertainty in valuations and potentially higher risk premiums. Valuators should consider both short-term market fluctuations and long-term trends when assessing the impact of market volatility on IP asset risk and value.

Financial Risks

Financial risks are inherent to the company’s financial structure and operations, directly impacting the cost of capital. These risks are crucial components of WACC calculations and can significantly influence IP valuations:

- Capital Structure Risk: The mix of debt and equity financing chosen by a company can substantially affect its overall risk profile and, consequently, the valuation of its IP assets. A higher proportion of debt may increase financial risk due to fixed interest payments, potentially leading to a higher WACC. Conversely, a more equity-heavy structure might reduce financial risk but could result in higher costs of capital due to equity investors’ higher return expectations.

- Liquidity Risk: The ease with which a company can meet its financial obligations is a critical factor in assessing its overall risk profile. Companies with high liquidity risk may face challenges in funding ongoing operations or investing in IP development, potentially impacting the value and future prospects of their intellectual property. Valuators should consider how liquidity constraints might affect the company’s ability to exploit or defend its IP assets effectively.

- Credit Risk: A company’s ability to service its debt obligations is a key component of its financial risk profile. Higher credit risk can lead to increased borrowing costs and potentially impact the company’s ability to invest in or monetize its IP assets. When calculating WACC for IP valuation, it’s important to consider how the company’s credit standing might affect its cost of debt and overall financial flexibility in managing its IP portfolio.

Operational Risks

Operational risks stem from the company’s internal processes, management decisions, and business environment. These risks can significantly impact the success and value of IP assets:

- Business Model👉 A business model outlines how a company creates, delivers, and captures value. Risk: The overall business strategy and operational approach of a company can greatly influence the potential value and risk profile of its IP assets. A well-aligned business model can enhance the value of IP by effectively leveraging it in the market, while a misaligned strategy might underutilize or even devalue the IP. Valuators should assess how well the company’s business model supports the exploitation and protection of its IP assets when considering this risk factor in WACC calculations.

- Management Risk: The quality and experience of a company’s leadership team play a crucial role in the effective management and exploitation of IP assets. Strong management can identify opportunities, navigate challenges, and maximize the value of IP, while weak leadership might fail to capitalize on the full potential of these assets. When assessing management risk, valuators should consider the track record of the leadership team in IP management👉 Strategic and operative handling of IP to maximize value., their industry expertise, and their ability to adapt to changing market conditions.

- Geographic Risks: The regions in which a company operates can introduce various risks that impact its IP assets. These may include political instability, economic volatility, or differences in IP protection laws across jurisdictions. For instance, operating in countries with weak IP enforcement might increase the risk of infringement, potentially reducing the value of the IP. Valuators should carefully consider the geographic footprint of the company and how it might affect the risk profile and potential value of its IP assets.

Regulatory and Legal Risks

Regulatory and legal risks are external factors that can significantly impact the value and viability of IP assets. These risks are particularly important in IP valuation due to the legal nature of intellectual property rights:

- Regulatory Environment: Changes in laws or regulations can have profound effects on the value and enforceability of IP assets. New regulations might create opportunities or pose challenges for certain types of IP, affecting their market potential and risk profile. For example, changes in patent laws could alter the strength of patent protection, while new data privacy regulations might impact the value of certain software or data-related IP. Valuators must stay informed about relevant regulatory trends and assess their potential impact on the IP being valued.

- Corporate Governance: The governance structure and practices of a company can influence its ability to manage and exploit IP assets effectively. Strong corporate governance can enhance IP management, ensure compliance with regulations, and mitigate risks associated with IP ownership and use. Conversely, weak governance might lead to mismanagement of IP assets, increased legal risks, or failure to capitalize on IP opportunities. When considering corporate governance in WACC calculations, valuators should assess the company’s track record in IP management, its internal controls, and its overall governance framework.

Technological Risks

Technological risks are particularly relevant for IP valuation, given the often technology-dependent nature of many IP assets. These risks can significantly impact the long-term value and viability of intellectual property:

- General Technological Changes: Broad technological shifts can have far-reaching effects on the value and relevance of IP assets across entire industries. Disruptive technologies may render existing IP obsolete or create new opportunities for innovation. For instance, the rise of artificial intelligence has impacted IP in various fields, from software to pharmaceuticals. When assessing this risk factor, valuators should consider the pace of technological change in the relevant industry, the adaptability of the IP to new technologies, and potential emerging technologies that could impact the IP’s value.

- Cybersecurity Risks: In an increasingly digital world, risks related to data breaches or technological vulnerabilities can significantly impact the value and security of IP assets. Cybersecurity threats may compromise confidential IP information, lead to unauthorized use or disclosure of trade secrets, or damage the reputation and trustworthiness of technology-based IP. Valuators should consider the company’s cybersecurity measures, the sensitivity of the IP to digital threats, and the potential impact of a security breach on the IP’s value when incorporating this risk into WACC calculations.

Conclusion

By incorporating these risks into the WACC, you ensure that the discount rate reflects the overall risk profile of the company and its environment, while the IP-specific risks are captured in the cash flow projections. This approach helps to avoid double-counting risks and provides a more accurate valuation of the IP asset.

It’s important to note that the WACC should be carefully adjusted to avoid overlap with the IP-specific risks already accounted for in the cash flows. The goal is to create a comprehensive risk assessment that accurately reflects both the unique characteristics of the IP asset and the broader context in which it exists.