In today’s knowledge-driven economy, intellectual property👉 Creations of the mind protected by legal rights. has become a critical asset for businesses across industries. Understanding the value of IP and how to accurately assess it is crucial for companies looking to leverage their intangible assets, make strategic decisions, and drive growth. This comprehensive guide explores key IP value concepts and valuation approaches to help organizations maximize the potential of their intellectual property portfolios.

Intellectual property valuation is both an art and a science, requiring a nuanced understanding of legal, technical, and economic factors. By mastering key value concepts and applying appropriate valuation methodologies, companies can unlock the full potential of their IP portfolios. Whether for strategic decision-making, financial reporting, or transactions, accurate IP valuation provides a foundation for effective intellectual asset management and value creation.

As the global economy becomes increasingly knowledge-driven, the ability to properly assess and leverage IP value will be a key differentiator for successful organizations. By investing in robust IP valuation capabilities, companies can turn their intangible assets into tangible competitive advantages.

IP Value Concepts

The Strategic Value of IP

Intellectual property represents far more than just legal rights – it embodies the innovative and creative output that gives companies their competitive edge. A strong IP portfolio can provide significant strategic and financial advantages in today’s knowledge-driven economy. Here are some key ways a robust IP portfolio can benefit companies:

- Create barriers to entry for competitors: Strong IP protection makes it difficult for competitors to copy or replicate a company’s innovations. This allows the IP owner to maintain market exclusivity and competitive advantage.

- Generate licensing👉 Permission to use a right or asset granted by its owner. revenue streams: Companies can monetize their IP by licensing it to other businesses. This creates an additional revenue stream without requiring direct commercialization.

- Enhance brand👉 A distinctive identity that differentiates a product, service, or entity. value and reputation: A strong IP portfolio signals innovation👉 Practical application of new ideas to create value. leadership and technological prowess. This enhances a company’s brand image and reputation in the marketplace.

- Attract investment and partnerships: Investors and potential business partners view strong IP as a valuable asset. A robust IP portfolio can help attract funding and strategic alliances.

- Enable premium pricing for products/services: Exclusive rights provided by IP allow companies to charge higher prices for their unique offerings. This supports premium positioning and higher profit margins.

Forward-thinking companies view IP as a strategic asset that can be actively managed to support business objectives. Rather than a cost center, IP should be seen as a value driver that can significantly impact a company’s market position and financial performance.

Types of IP Value

Intellectual property (IP) is a complex asset whose true worth extends beyond simple monetary measures. When evaluating IP, it’s crucial to consider multiple dimensions of value that capture its full potential and impact on a business. Here are five key types of value to examine when assessing intellectual property:

- Inherent Value

This represents the fundamental worth of the IP based on its innovative or creative merits alone. It reflects the IP’s intrinsic quality and potential, independent of how it’s currently being used or marketed. - Utilization Value

This measures the tangible benefits derived from actively employing the IP within a business. It quantifies the IP’s contribution to revenue generation, cost savings, or operational improvements. - Market Value

This indicates what the IP could realistically sell or license for in an arm’s length transaction. It’s based on comparable market data and reflects current demand for similar intellectual property assets. - Strategic Value

This assesses how the IP supports and advances broader business objectives and competitive advantage. It considers the IP’s role in market positioning, growth strategies, and long-term business sustainability. - Legal Value

This evaluates the strength, scope, and enforceability of the IP rights from a legal perspective. It takes into account factors like the clarity of claims, ability to withstand challenges, and ease of detecting infringement.

A holistic valuation approach should account for these different value dimensions to arrive at a comprehensive assessment.

Value Drivers and Influencing Factors

Intellectual property (IP) assets are complex and multifaceted, with their value influenced by a wide range of factors. Understanding these value drivers is crucial for accurately assessing and maximizing the potential of IP portfolios. Companies must carefully consider both internal and external elements that can enhance or diminish IP value. Here are some key factors that can significantly impact the value of intellectual property assets:

Scope and strength of legal protection

The breadth and enforceability of IP rights directly affect their value. Strong, well-drafted patents or trademarks with broad claims provide greater exclusivity and market power. Conversely, narrow or weak protection may limit the ability to prevent competitors from entering the market. The strength of legal protection also influences the IP’s ability to withstand potential challenges or litigation.

Stage of development/commercialization

The maturity of the technology or brand associated with the IP plays a crucial role in its valuation. Early-stage innovations may have significant potential but also carry higher risks and uncertainties. More developed IP that is already generating revenue or has proven market acceptance typically commands higher valuations. The stage of development also affects the timeline for realizing economic benefits from the IP.

Market size and growth potential

The addressable market for products or services related to the IP is a key value driver. Larger markets offer greater revenue potential and opportunities for scale. Additionally, the projected growth rate of the market influences future value expectations. IP assets in rapidly expanding markets or emerging industries may be valued more highly due to their long-term growth prospects.

Competitive landscape

The strength and positioning of competitors in the market impact IP value. A dominant IP position in a crowded field can be highly valuable for maintaining market share. Conversely, the presence of numerous alternatives or substitute technologies may diminish the IP’s worth. The competitive landscape also affects the potential for licensing or cross-licensing opportunities within the industry.

Technological trends and obsolescence risk

The pace of technological change can significantly impact the value of IP assets. Rapid advancements may quickly render certain technologies obsolete, diminishing the value of related patents or trade secrets. Conversely, IP that aligns with or drives emerging technological trends may see its value increase substantially. Valuators must carefully assess the current technological landscape and forecast future developments to accurately gauge the long-term value potential of IP assets.

Regulatory environment

Government regulations and policies can have a profound effect on IP value across various industries. Changes in patent👉 A legal right granting exclusive control over an invention for a limited time. laws, environmental regulations, or industry-specific rules can either enhance or diminish the worth of certain IP assets. For example, stricter environmental regulations may increase the value of green technologies, while relaxed patent enforcement in certain jurisdictions could reduce the value of patent portfolios. Valuators must stay informed about current and potential future regulatory changes that could impact the IP being assessed.

Licensing/monetization opportunities

The potential for generating revenue through licensing or other monetization strategies can significantly influence IP value. Assets with broad applicability across multiple industries or products may have greater licensing potential and thus higher value. The existence of established licensing programs or markets for similar technologies can provide valuable benchmarks for valuation. Valuators should consider both current and potential future licensing opportunities when assessing IP value.

Synergies with other company assets

The value of IP often depends on how well it integrates with and complements a company’s other assets and capabilities. IP that enhances or enables key products, processes, or business models may be worth more to the company than its standalone value would suggest. Additionally, the combination of multiple IP assets (e.g., patents, trademarks, and trade secrets) can create a more robust and valuable IP portfolio. Valuators should carefully consider the strategic fit and potential synergies between the IP being valued and the company’s broader asset base.

Understanding these value drivers allows organizations to take steps to enhance and protect the worth of their IP portfolios over time.

IP Valuation Approaches

Accurately valuing intellectual property presents unique challenges due to its intangible nature and the complexities of assessing future economic benefits. However, several established approaches can be used to determine IP value:

Cost Approach

The cost approach is a fundamental method for valuing intellectual property (IP) assets, based on the principle of replacement. It estimates the value of IP by calculating the costs that would be incurred to develop or acquire a similar asset with equivalent utility. This method is particularly useful for early-stage or internal valuations of IP assets. While straightforward, the cost approach has limitations as it doesn’t account for future economic potential. Here’s a breakdown of the key cost elements considered in this approach:

Research and development costs

These encompass all expenses associated with creating the IP, including personnel salaries, equipment, materials, and facilities. R&D costs often represent the most significant portion of IP development expenses. They can include both successful and unsuccessful research efforts that contributed to the final IP. Accurately tracking and allocating R&D costs is crucial for this valuation method.

Patent filing and maintenance fees

This category includes all official fees paid to patent offices for filing, examination, and maintenance of the IP rights. It covers application fees, search fees, examination fees, and periodic maintenance or renewal fees. These costs can vary significantly depending on the jurisdictions where protection is sought and the lifespan of the IP. For international patent portfolios, these fees can be substantial over time.

Legal costs for IP protection

These expenses relate to attorney fees and other legal services required to secure and defend IP rights. This includes costs for drafting patent applications, responding to office actions, and potentially litigation expenses to enforce the IP. Legal costs can be significant, especially for complex technologies or in cases of IP disputes. Ongoing legal expenses for monitoring and maintaining the IP portfolio should also be considered.

Opportunity costs

This element accounts for the economic value of alternative investments or uses of resources that were foregone to develop the IP. It represents the potential returns that could have been earned if the resources were allocated elsewhere. Opportunity costs can be challenging to quantify but are important for understanding the full economic impact of IP development. They may include lost profits from delayed product launches or diverted resources from other projects.

Market Approach

The market approach is a widely used method for valuing intellectual property (IP) assets based on analyzing comparable transactions in the market. This approach aims to determine the value of IP by examining recent sales or licensing deals involving similar assets. While conceptually straightforward, the market approach requires careful analysis and adjustment to account for differences between the subject IP and comparable transactions. Here’s an overview of the key steps involved in applying the market approach to IP valuation:

Identifying relevant comparable transactions

This crucial first step involves researching and finding recent deals involving IP assets similar to the one being valued. The valuator must search databases, industry reports, and other sources to locate transactions involving comparable patents, trademarks, copyrights, or other IP. Ideally, the comparable transactions should be in the same industry, involve similar technologies or brands, and have occurred relatively recently. The quality and relevance of the comparable transactions identified will significantly impact the reliability of the valuation.

Adjusting for differences in IP characteristics

Once comparable transactions are identified, the valuator must analyze the similarities and differences between those assets and the subject IP. This involves examining factors like the scope of IP protection, remaining patent life, market size, stage of development, and other relevant characteristics. The valuator then makes quantitative and qualitative adjustments to account for these differences, ensuring the comparable transactions provide an appropriate basis for valuing the subject IP. This step requires significant expertise and judgment to properly calibrate the comparables.

Applying appropriate valuation multiples

After adjusting for differences, the valuator derives and applies valuation multiples from the comparable transactions to the subject IP. Common multiples include price-to-sales ratios, royalty rates, or price per patent. The valuator may use multiple valuation metrics and weight them based on their relevance and reliability. Careful consideration must be given to selecting the most appropriate multiples that reflect the value drivers of the specific IP asset being valued. The final step involves synthesizing the various data points to arrive at a supportable value conclusion for the subject IP.

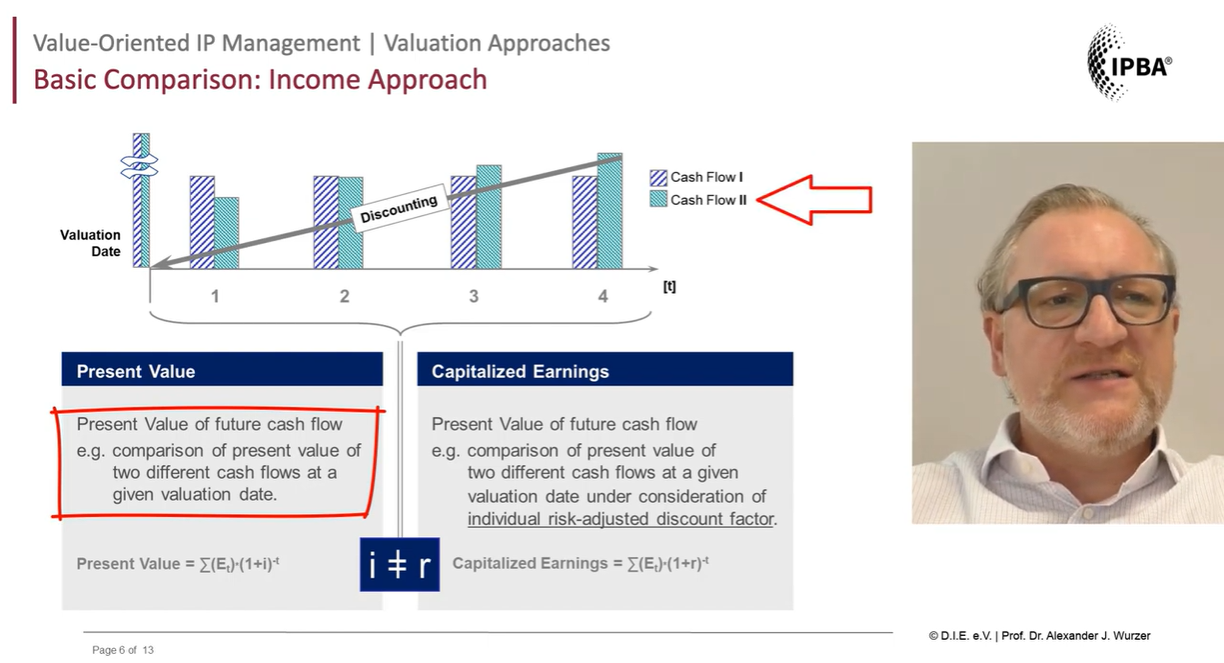

Income Approach

The income approach is a widely used method for valuing intellectual property (IP) assets based on their potential to generate future economic benefits. This approach recognizes that the true value of IP lies not in its historical costs or comparable market transactions, but in its ability to drive future cash flows and profits for its owner. By focusing on projected financial performance, the income approach provides a forward-looking valuation that aligns closely with how businesses actually derive value from their IP assets. While it requires careful financial modeling and relies on assumptions about future performance, the income approach offers a flexible framework for capturing the unique value proposition of different types of IP across various industries and business models.

Discounted Cash Flow (DCF)

This method involves projecting the future cash flows that can be directly attributed to the IP asset and then discounting them back to present value. The DCF approach requires a detailed forecast of revenues, costs, and profits associated with the IP over its expected economic life. A key challenge is isolating the cash flows specifically generated by the IP asset from those of the overall business. The discount rate used reflects the risk👉 The probability of adverse outcomes due to uncertainty in future events. associated with realizing the projected cash flows, typically based on the weighted average cost of capital (WACC) or a risk-adjusted rate. Despite its complexity, the DCF method provides a comprehensive view of the IP’s value over time.

Relief from Royalty

This method estimates the value of IP by calculating the royalty payments that would be required if the company did not own the IP and had to license it from a third party. The approach begins by determining an appropriate royalty rate based on industry standards or comparable licensing agreements. This rate is then applied to projected revenues over the IP’s economic life to calculate the hypothetical royalty payments. These payments are then discounted to present value, representing the “relief” or savings the company enjoys by owning the IP outright. The relief from royalty method is particularly useful for valuing trademarks and patents with established licensing markets.

Excess Earnings

This method focuses on quantifying the additional profit generated by the IP asset compared to using alternative technologies or assets. It involves calculating the total earnings of the business unit utilizing the IP, then subtracting the earnings attributable to all other assets (tangible and intangible) to isolate the “excess” earnings generated by the IP. These excess earnings are then projected over the IP’s economic life and discounted to present value. The excess earnings method is particularly useful for valuing customer relationships, technology, and other IP assets that contribute to a company’s overall profitability but may not generate direct cash flows.

Profit Split

This approach allocates a portion of a company’s total profits to the IP asset based on its relative importance to the business. The method typically involves analyzing the functions, assets, and risks associated with the IP and determining its contribution to the overall value chain👉 A series of activities that create and deliver value in a product for end-users.. Based on this analysis, a percentage of profits is attributed to the IP asset. This profit allocation is then projected over the IP’s economic life and discounted to present value. The profit split method is often used in transfer pricing scenarios and can be helpful in valuing IP assets that are deeply integrated into a company’s operations and difficult to isolate.

Option Pricing Methods

Black-Scholes Model

This model treats intellectual property as a call option on future revenues. It considers factors like the current value of the IP, the investment required to commercialize it, the time until commercialization, the risk-free interest rate, and the volatility of the underlying asset. The Black-Scholes model can be particularly useful for valuing patents with clear commercialization timelines and revenue projections.

Binomial Lattice

This approach models different commercialization scenarios and their associated probabilities over time. It creates a tree-like structure that represents various possible outcomes at different decision points in the IP development and commercialization process. The binomial lattice is especially valuable for IP with multiple potential applications or development paths.

Monte Carlo Simulation

This method runs hundreds or thousands of scenarios to account for various uncertainties in IP valuation. It incorporates multiple variables and their potential ranges to generate a probability distribution of possible values. Monte Carlo simulation is particularly useful for complex IP portfolios or technologies with highly uncertain market outcomes.

These option pricing methods can capture the flexibility and risk inherent in IP development, making them well-suited for early-stage technologies or IP with uncertain commercialization paths. However, they often require sophisticated modeling skills and substantial data inputs, which can be challenging to obtain for unique or emerging technologies.

Hybrid/Multi-Method Approaches

Given the inherent limitations of individual valuation methods, many experts advocate for using multiple approaches and reconciling the results. This multi-method strategy can provide a more comprehensive view of an IP asset’s value by considering different perspectives and assumptions. By comparing and contrasting results from various methods, valuators can identify potential biases or oversights in their analysis.

Hybrid approaches often combine elements of cost, market, and income methods to create a more robust valuation framework. For example, a valuator might use the cost approach to establish a baseline value, the market approach to validate assumptions, and the income approach to project future economic benefits. This multi-faceted approach can be particularly valuable for complex IP portfolios or in situations where a single method may not capture all relevant value drivers.

Choosing the Right Valuation Approach

Choosing the right valuation approach for intellectual property (IP) is crucial for obtaining accurate and meaningful results. The selection process requires careful consideration of multiple factors that can significantly impact the valuation outcome. A well-chosen method ensures that the valuation aligns with the specific context, characteristics, and objectives of the IP asset in question. Here are key factors to consider when selecting an appropriate IP valuation approach:

Purpose of the valuation (e.g. financial reporting, M&A, licensing)

The intended use of the valuation plays a critical role in determining the most suitable approach. Financial reporting valuations may require adherence to specific accounting standards, while M&A valuations might focus more on strategic value. Licensing valuations often emphasize market-based approaches to determine fair royalty rates. The chosen method must provide results that are relevant and defensible for the specific purpose at hand.

Type and characteristics of the IP asset

Different types of IP assets (patents, trademarks, copyrights, trade secrets) may require different valuation approaches. For example, patents might be better suited to income-based methods if they generate direct revenue streams, while trademarks might benefit from market-based approaches that consider brand value. The unique characteristics of the IP, such as its strength, scope, and remaining life, also influence the choice of valuation method.

Stage of development/commercialization

The maturity of the IP asset in its lifecycle impacts the appropriate valuation approach. Early-stage technologies with uncertain commercial prospects might be better valued using option pricing methods, while established IP generating stable cash flows could be more suited to traditional income approaches. The stage of development affects the availability and reliability of financial projections, which in turn influences method selection.

Availability of market data

The accessibility of relevant market information significantly impacts the feasibility of certain valuation approaches. Market-based methods require sufficient comparable transaction data, which may not always be available for unique or highly specialized IP assets. In cases where market data is scarce, income or cost approaches might be more appropriate. The quality and quantity of available data should be carefully assessed when choosing a valuation method.

Organizations should work with experienced IP valuation professionals to determine the best approach for their specific situation and objectives.

Challenges in IP Valuation

Intellectual property (IP) valuation is a complex and nuanced process that presents unique challenges compared to valuing traditional tangible assets. The intangible nature of IP, combined with its critical role in driving innovation and competitive advantage, makes accurate valuation both essential and difficult. Understanding these challenges is crucial for IP owners, investors, and valuation professionals to develop robust methodologies and make informed decisions. Here are some of the key challenges inherent in IP valuation:

Uniqueness

Every IP asset is unique, making comparisons difficult. IP assets are inherently one-of-a-kind creations, reflecting specific innovations or creative works. This uniqueness makes it challenging to find truly comparable assets for benchmarking purposes. Valuation experts must often rely on imperfect analogies or make significant adjustments to account for differences between assets. The lack of direct comparables can introduce subjectivity and uncertainty into the valuation process.

Future Uncertainty

The future economic benefits of IP can be highly unpredictable. The value of IP is largely derived from its potential to generate future income or competitive advantage. However, forecasting these future benefits is fraught with uncertainty, especially for emerging technologies or creative works. Market conditions, consumer preferences, and technological advancements can all dramatically impact an IP asset’s future value. This uncertainty makes it difficult to apply traditional discounted cash flow models with confidence.

Bundled Value

IP often generates value in conjunction with other assets, making isolation difficult. In many cases, the value of IP is closely intertwined with other assets, both tangible and intangible. For example, a patented technology may only generate significant value when combined with specific manufacturing capabilities or brand recognition. Isolating the portion of value attributable solely to the IP asset can be a complex and subjective exercise. This bundling effect can lead to challenges in accurately apportioning value in licensing, sale, or litigation scenarios.

Rapid Obsolescence

Technological change can quickly erode IP value. The fast pace of innovation in many industries means that the value of certain IP assets can decline rapidly as new technologies emerge. This is particularly true for patents in high-tech fields. Valuation models must account for the potential for technological obsolescence and the impact it may have on an asset’s useful economic life. Estimating the rate of obsolescence and its effect on future cash flows adds another layer of complexity to the valuation process.

Legal Complexities

Changes in IP laws or validity challenges can impact enforceability and value. The value of IP is intrinsically linked to the legal rights it confers and the ability to enforce those rights. Changes in IP laws, court decisions, or successful challenges to the validity of an IP asset can significantly impact its value. Valuation professionals must consider the strength of the legal protection and potential risks to enforceability. This requires a deep understanding of IP law and the ability to assess legal risks in addition to economic factors.

Limited Market Data

Lack of transparent, comparable transaction data for many IP types. Unlike publicly traded stocks or real estate, there is often a scarcity of public information on IP transactions. Many IP deals are conducted privately, with terms and conditions kept confidential. This lack of transparent market data makes it difficult to apply market-based valuation approaches. Valuation experts must often rely on limited or incomplete data sets, proprietary databases, or broad industry benchmarks, which can introduce additional uncertainty into the valuation process.

Addressing these challenges requires a combination of industry expertise, financial acumen, and sound judgment in applying valuation methodologies.

Best Practices for IP Valuation

Intellectual property (IP) valuation is a complex and nuanced process that requires careful consideration of multiple factors. To ensure accurate, reliable, and defensible valuations, organizations should adhere to best practices that encompass thorough analysis, rigorous methodology, and comprehensive documentation. These practices help mitigate risks, enhance credibility, and provide a solid foundation for strategic decision-making related to IP assets. By following these guidelines, companies can maximize the value of their intellectual property portfolios and make informed choices about IP management👉 Strategic and operative handling of IP to maximize value., transactions, and investments. Here are ten essential best practices for conducting robust IP valuations:

- Clearly define the purpose and scope of the valuation:

Establishing a clear purpose and scope is the critical first step in any IP valuation process. This involves identifying the specific reasons for conducting the valuation, such as financial reporting, M&A transactions, licensing negotiations, or internal strategic planning. The scope should outline which IP assets are included, the valuation date, and any specific assumptions or limitations. A well-defined purpose and scope ensure that the valuation approach aligns with the intended use of the results and helps focus the analysis on the most relevant factors. - Gather comprehensive information on the IP asset and its context:

Thorough information gathering is essential for an accurate IP valuation. This includes collecting detailed data on the IP asset itself, such as patent claims, registration details, and development history. Additionally, it’s crucial to understand the broader context in which the IP operates, including market conditions, competitive landscape, and industry trends. Comprehensive information allows for a more nuanced analysis of the IP’s potential value and helps identify key value drivers and risks. - Conduct thorough due diligence on legal status and enforceability:

The legal status and enforceability of IP rights are fundamental to their value. Due diligence should include a review of the IP’s legal protection, including the strength and scope of patents or trademarks, any ongoing or potential legal challenges, and the remaining term of protection. This process may involve patent searches, freedom-to-operate analyses, and consultations with legal experts. Understanding the legal landscape helps assess the IP’s ability to exclude competitors and generate economic benefits. - Use multiple valuation methods when possible:

Employing multiple valuation methods provides a more comprehensive and robust assessment of an IP asset’s value. Common approaches include the cost, market, and income methods, as well as more specialized techniques like real options analysis. By using multiple methods, valuators can cross-check results, identify potential discrepancies, and develop a more nuanced understanding of the IP’s value. This multi-method approach also helps address the inherent uncertainties and complexities in IP valuation. - Validate key assumptions and inputs:

IP valuations often rely on numerous assumptions and inputs, such as future cash flows, discount rates, and market growth projections. It’s crucial to validate these key elements through market research, industry benchmarks, and expert opinions. Sensitivity analysis can help identify which assumptions have the most significant impact on the valuation results. By rigorously validating assumptions and inputs, valuators can enhance the credibility and reliability of their findings. - Consider scenario analysis to account for uncertainties:

Scenario analysis is a powerful tool for addressing the inherent uncertainties in IP valuation. This approach involves developing multiple plausible future scenarios that could impact the value of the IP asset. For each scenario, the valuator estimates the probability of occurrence and the potential impact on the IP’s value. By considering a range of possible outcomes, scenario analysis provides a more nuanced understanding of the IP’s value under different conditions. This method is particularly useful for valuing IP in rapidly changing industries or for early-stage technologies where future market conditions are highly uncertain. - Document the valuation process and rationale thoroughly:

Comprehensive documentation of the IP valuation process is crucial for transparency and defensibility. This should include detailed descriptions of the methodology used, key assumptions made, and data sources consulted. The rationale behind important decisions and judgments should be clearly explained and supported with evidence. Thorough documentation helps in communicating the valuation results to stakeholders and provides a solid foundation for future reference or review. It also serves as a valuable resource in case the valuation is challenged or needs to be updated in the future. - Engage independent experts for high-stakes valuations:

For valuations with significant financial or strategic implications, it’s advisable to engage independent, qualified experts. These professionals bring specialized knowledge, objectivity, and credibility to the valuation process. Independent experts can provide an unbiased perspective, helping to mitigate potential conflicts of interest or perception of bias. Their involvement can be particularly valuable in complex cases, litigation support, or when dealing with novel technologies or markets. Engaging external experts also demonstrates due diligence and can enhance the reliability and acceptability of the valuation results. - Regularly reassess IP value as market conditions change:

IP valuation should not be treated as a one-time exercise but as an ongoing process. Market conditions, technological landscapes, and competitive environments are dynamic, potentially impacting IP value over time. Regular reassessment allows companies to stay informed about changes in their IP portfolio’s value and make timely strategic decisions. This practice is particularly important for key assets or in rapidly evolving industries. Periodic revaluations can help identify emerging opportunities or risks and inform decisions about IP maintenance, enforcement, or monetization strategies. - Align valuation practices with relevant accounting/regulatory standards:

IP valuation practices should be consistent with applicable accounting standards and regulatory requirements. This alignment ensures that valuations are compliant with financial reporting obligations and can withstand scrutiny from auditors or regulators. Familiarity with standards such as IFRS and GAAP, as well as specific industry regulations, is essential. Staying up-to-date with changes in these standards and adjusting valuation practices accordingly is crucial for maintaining compliance. Proper alignment also facilitates the integration of IP valuation results into broader financial and strategic planning processes within the organization.