Patent👉 A legal right granting exclusive control over an invention for a limited time. valuation is a critical process in intellectual property👉 Creations of the mind protected by legal rights. management, providing insights into the economic potential and strategic importance of inventions. Among various approaches to patent valuation, the indicator-based method has gained significant traction due to its ability to provide objective, quantifiable metrics for assessing patent value👉 Economic benefit derived from a patent's use.. This article explores the intricacies of indicator-based patent evaluation, its advantages, limitations, and practical applications in the modern innovation👉 Practical application of new ideas to create value. landscape.

Indicator-based patent evaluation offers a powerful tool for assessing the value of intellectual property assets. By leveraging quantifiable metrics, this approach provides objective insights into patent value, facilitating more informed decision-making in patent management, strategy, and transactions. While it has limitations, particularly in capturing qualitative aspects and market-specific nuances, its efficiency and scalability make it an invaluable component of modern IP valuation practices.

As technology advances and data availability improves, indicator-based valuation methods are likely to become even more sophisticated and accurate. However, the most effective approach to patent valuation will likely continue to involve a combination of indicator-based methods with other valuation techniques and expert analysis. This holistic approach ensures a comprehensive understanding of a patent’s true value, considering both quantitative indicators and qualitative factors that drive innovation and market success.

In an era where intellectual property plays an increasingly central role in business strategy and economic growth, mastering the art and science of patent valuation, including indicator-based approaches, is crucial for companies, investors, and policymakers alike. As the field continues to evolve, staying abreast of new developments in indicator-based valuation will be essential for anyone involved in the management and strategic use of patents and intellectual property.

Understanding Indicator-Based Patent Evaluation

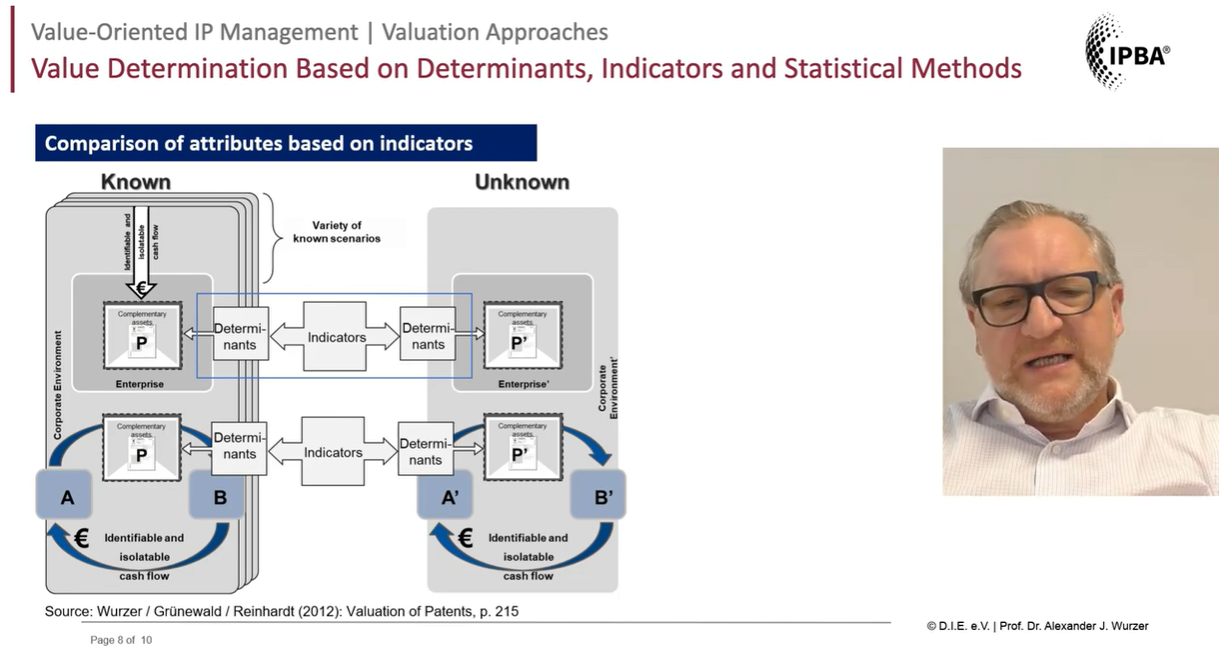

Indicator-based patent valuation is a qualitative approach that assesses a patent’s value by examining specific features or characteristics of the patent itself. This method relies on the premise that certain attributes of a patent correlate with its economic and strategic value. By analyzing these indicators, stakeholders can gain insights into a patent’s potential worth without necessarily conducting complex financial analyses or market assessments.

Key Indicators of Patent Value

Several indicators have been identified as reliable predictors of patent value. These include:

- Forward Citations: The number of times a patent is cited by subsequent patents is often considered a strong indicator of its value. Forward citations suggest that the patent has influenced further innovations and is likely of significant technological importance.

- Backward Citations: The number of prior patents cited by the patent in question can indicate its technological breadth and the extent of its innovation.

- Patent Family Size: A larger patent family size, indicating protection in multiple jurisdictions, often suggests higher value due to the broader market coverage and the patent holder’s willingness to invest in widespread protection.

- Claims: The number and quality of claims in a patent can indicate its scope of protection and potential value.

- Lifespan: Patents maintained for longer periods, especially those renewed despite increasing fees, are often considered more valuable.

- Litigation History: Patents that have been involved in litigation, particularly those successfully defended, may be indicative of higher value.

- Technological Relevance: The alignment of a patent’s technology with current market trends or emerging fields can significantly impact its value.

- Inventor👉 A person who creates new devices, methods, or processes. Profile: The number of inventors and their reputation in the field can influence a patent’s perceived value.

- Patent Status: Whether a patent is granted or still pending can affect its valuation.

- International Patent Classification (IPC): The breadth and specificity of a patent’s IPC classifications can indicate its technological scope and potential applications.

Advantages of Indicator-Based Valuation

Indicator-based patent valuation is a powerful method for assessing the worth of intellectual property assets. This approach relies on quantifiable metrics to evaluate patents, offering a systematic and data-driven alternative to traditional valuation methods. By analyzing key indicators such as forward citations, patent family size, and technological relevance, this method provides valuable insights into a patent’s potential economic and strategic value.

Objectivity

Indicator-based valuation significantly reduces subjective bias in patent assessment. By relying on quantifiable metrics, this method provides a more impartial evaluation of a patent’s worth. This objectivity is particularly valuable in situations where personal opinions or vested interests might otherwise influence the valuation process, ensuring a more reliable and consistent assessment across different patents and portfolios.

Comparability

The use of standardized indicators allows for easier comparison between different patents and across various technological fields. This comparability is crucial for organizations managing diverse patent portfolios or conducting competitive analysis. By providing a common framework for evaluation, indicator-based valuation enables stakeholders to make more informed decisions about patent acquisition, maintenance, and strategic positioning in the market.

Efficiency

Indicator-based valuation offers a quick and cost-effective approach to patent assessment, especially when dealing with large patent portfolios. This efficiency is particularly beneficial for organizations that need to evaluate numerous patents in a short timeframe. By streamlining the valuation process, companies can allocate resources more effectively and make timely decisions regarding their intellectual property assets.

Scalability

The scalability of indicator-based valuation makes it an invaluable tool for portfolio management👉 Strategic management of diverse assets to optimize returns and balance risk. and strategic decision-making. This approach allows organizations to assess and compare large numbers of patents efficiently, providing a comprehensive view of their intellectual property landscape. The ability to scale the valuation process enables companies to identify trends, prioritize assets, and make informed decisions about patent maintenance, licensing👉 Permission to use a right or asset granted by its owner., or divestment strategies.

Data-Driven Insights

Indicator-based valuation provides a solid foundation for data-driven analysis of patent value. This approach enables the identification of trends and patterns across industries or over time, offering valuable insights for strategic planning and innovation management. By leveraging these data-driven insights, organizations can make more informed decisions about their R&D investments, technology acquisitions, and overall intellectual property strategy.

Limitations and Challenges

While indicator-based patent valuation offers numerous advantages, it is not without its limitations and challenges. These drawbacks can impact the accuracy and comprehensiveness of patent valuations, potentially leading to misinterpretations or overlooked opportunities. Understanding these limitations is crucial for practitioners and decision-makers to apply this valuation method effectively and complement it with other approaches when necessary.

Contextual Factors

Indicator-based valuation may struggle to fully account for the complex market dynamics and business strategies that influence a patent’s true value. This limitation can lead to an incomplete assessment of a patent’s worth, particularly in rapidly evolving industries or unique market situations. Consequently, relying solely on indicators without considering the broader context may result in valuations that fail to capture the full potential or strategic importance of certain patents.

Technological Nuances

Highly innovative or disruptive patents may not align well with traditional valuation indicators, potentially leading to undervaluation of breakthrough technologies. This limitation is particularly problematic for cutting-edge inventions that don’t fit established patterns or metrics. As a result, truly groundbreaking patents might be overlooked or underappreciated when evaluated solely through indicator-based methods.

Time Lag

Some key indicators, such as forward citations, require time to accumulate, which can lead to undervaluation of newer patents. This time lag creates a bias towards older patents and may not accurately reflect the current value or potential of recent innovations. Consequently, relying heavily on time-dependent indicators can disadvantage newer patents and potentially misrepresent the current state of innovation in rapidly advancing fields.

Industry Variations

The significance and weighting of different indicators can vary considerably across industries and technological domains. This variation makes it challenging to apply a one-size-fits-all approach to patent valuation across diverse sectors. As a result, indicator-based valuations may require industry-specific adjustments or interpretations to provide accurate and meaningful results in different technological contexts.

Qualitative Aspects

Purely quantitative indicators may fail to capture important qualitative aspects of a patent’s value, such as its strategic fit within a company’s portfolio or its potential for future development. This limitation can lead to an incomplete understanding of a patent’s true worth beyond its measurable characteristics. Consequently, relying solely on quantitative indicators may overlook critical strategic or synergistic values that certain patents bring to an organization’s overall intellectual property strategy.

Practical Applications

Indicator-based patent valuation is a versatile tool with wide-ranging applications in the business world. This approach leverages quantifiable metrics to assess patent value, offering practical insights for various strategic decisions. From portfolio management to competitive analysis, the indicator-based method provides a data-driven foundation for navigating the complex landscape of intellectual property.

Portfolio Management

Indicator-based valuation plays a crucial role in effective patent portfolio management. By applying this approach, companies can systematically assess and prioritize their patent assets, identifying those with the highest potential value. This method enables organizations to make informed decisions about which patents to maintain, monetize, or abandon, optimizing their intellectual property portfolio for maximum strategic and financial benefit.

Mergers and Acquisitions

In the context of mergers and acquisitions, indicator-based valuation serves as a valuable tool for rapid assessment of a target company’s patent portfolio. This approach allows acquiring companies to quickly gauge the potential value and strategic fit of the target’s intellectual property assets. By providing an objective, data-driven evaluation, indicator-based valuation helps inform decision-making and negotiations in M&A transactions.

Licensing Negotiations

Indicator-based valuation provides a solid foundation for licensing negotiations by offering objective metrics to assess patent value. This approach helps both licensors and licensees establish a starting point for determining fair and reasonable royalty rates or licensing fees. By grounding discussions in quantifiable indicators, parties can engage in more informed and productive negotiations, potentially leading to mutually beneficial licensing agreements.

Research and Development Strategy

Companies can leverage indicator-based patent valuation to inform and guide their R&D strategies. By analyzing patent indicators across various technological fields, organizations can identify emerging trends, areas of high innovation activity, and potential gaps in the market. This insight allows companies to align their R&D efforts with promising areas of technological development, potentially leading to more impactful and valuable innovations.

Competitive Intelligence

Indicator-based valuation serves as a powerful tool for competitive intelligence by providing insights into competitors’ technological strengths and strategic focus. By analyzing the patent portfolios of rival companies using these indicators, organizations can gain a deeper understanding of their competitors’ innovation strategies and potential future directions. This information can be invaluable for strategic planning, market positioning, and identifying potential areas for collaboration or competition👉 Rivalry between entities striving for a shared goal or limited resource..

Patent Monetization

For companies looking to monetize their patent assets through sales or licensing, indicator-based valuation offers a systematic approach to identifying the most valuable patents. This method helps organizations prioritize their monetization efforts by focusing on patents with the highest potential value as indicated by various metrics. By strategically selecting patents for monetization based on these indicators, companies can maximize their return on investment in intellectual property development and management.

Advanced Approaches in Indicator-Based Valuation

The field of indicator-based patent valuation is rapidly evolving, with advanced approaches emerging to address the complexities of modern intellectual property landscapes. These sophisticated methods leverage cutting-edge technologies and nuanced analytical techniques to enhance the accuracy and relevance of patent valuations. As the industry progresses, these advanced approaches are reshaping how we understand and assess the value of patents in an increasingly dynamic and interconnected world.

Machine Learning and AI

Machine learning and AI are revolutionizing indicator-based patent valuation by unlocking new levels of analytical power and insight. These advanced algorithms can process vast amounts of patent data, identifying intricate patterns and relationships that human analysts might overlook. By considering a wider range of factors and their complex interactions, AI-driven approaches offer the potential for more nuanced and accurate valuations, capturing subtleties in patent value that traditional methods might miss.

Composite Indicators

The development of composite indicators represents a significant advancement in indicator-based patent valuation. These sophisticated metrics combine multiple individual indicators into a single, comprehensive score, providing a more holistic assessment of patent value. By balancing different aspects of a patent’s strength, composite indicators offer a more nuanced view of its overall worth, potentially capturing value dimensions that single indicators might overlook.

Industry-Specific Models

Recognizing the diverse nature of different technological fields, valuation experts are developing industry-specific models to enhance the accuracy of indicator-based valuations. These tailored approaches adjust the weight and relevance of various indicators based on the unique characteristics of particular sectors. By accounting for industry-specific factors, these models provide more contextually relevant and accurate valuations, reflecting the true value of patents within their specific technological ecosystems.

Dynamic Valuation

Advanced approaches in indicator-based valuation are increasingly incorporating dynamic elements to reflect the changing value of patents over time. These models consider factors such as technological obsolescence, market shifts, and evolving legal landscapes to provide a more realistic assessment of a patent’s value throughout its lifecycle. By accounting for these temporal factors, dynamic valuation approaches offer a more forward-looking and adaptable assessment of patent value, crucial in rapidly evolving technological landscapes.

Case Studies and Empirical Evidence

Empirical research has played a crucial role in validating the effectiveness of indicator-based patent valuation methods. These studies have examined various indicators and their correlation with patent value, providing a solid foundation for the use of such metrics in practical applications. The following case studies and empirical evidence highlight the significance of different indicators in assessing patent value across diverse contexts and industries.

A study by Hall et al. (2005) found a strong correlation between forward citations and the market value of firms, suggesting that highly cited patents are indeed more valuable. This research underscores the importance of forward citations as a key indicator of patent value. By demonstrating a clear link between citation counts and market valuation, the study provides strong support for the use of citation analysis in patent valuation methodologies. The findings suggest that patents receiving more citations are likely to represent more significant technological advancements or have greater commercial potential.

Research by Harhoff et al. (2003) demonstrated that patents renewed to full term were more likely to be cited, supporting the use of both renewal decisions and citations as value indicators. This study highlights the interconnectedness of different patent value indicators. By showing that patents maintained for longer periods tend to accumulate more citations, the research validates the use of both renewal data and citation counts in assessing patent value. The findings suggest that patent holders are more likely to invest in maintaining patents that have ongoing technological relevance and potential economic value.

A comprehensive analysis by van Zeebroeck (2011) across various European patents showed that a combination of indicators, including family size, forward citations, and grant decisions, provided robust estimates of patent value. This research emphasizes the importance of using multiple indicators for a more accurate valuation. By demonstrating that a combination of different metrics yields more reliable value estimates, the study supports a holistic approach to indicator-based patent valuation. The findings suggest that considering a range of factors can provide a more nuanced and comprehensive assessment of patent value.

Allison et al. (2009) found that litigated patents, which are often considered more valuable, tended to have higher numbers of claims and citations, supporting the use of these indicators in valuation. This study provides insight into the characteristics of patents that are deemed valuable enough to defend in court. By showing that litigated patents typically have more claims and receive more citations, the research validates the use of these metrics as indicators of patent value. The findings suggest that patents with more comprehensive protection (as indicated by claim count) and greater technological impact (as indicated by citations) are more likely to be involved in litigation, reflecting their perceived value.

Best Practices in Indicator-Based Valuation

Implementing best practices in indicator-based patent valuation is crucial for obtaining accurate and meaningful results. These guidelines help practitioners navigate the complexities of patent assessment, ensuring a more comprehensive and nuanced approach to valuation. By adhering to these best practices, organizations can enhance the reliability and effectiveness of their indicator-based valuation processes, leading to more informed decision-making in patent management and strategy.

Combine Multiple Indicators

Utilizing a combination of indicators is essential for a more accurate and comprehensive patent valuation. Relying on a single metric can lead to biased or incomplete assessments, potentially overlooking critical aspects of a patent’s value. By integrating multiple indicators, such as forward citations, family size, and technological relevance, valuators can create a more balanced and robust evaluation of a patent’s worth, capturing various dimensions of its potential value and impact.

Consider Industry Context

Recognizing and accounting for industry-specific nuances is crucial in indicator-based patent valuation. Different technological fields may prioritize certain indicators over others, reflecting the unique characteristics and dynamics of each sector. Tailoring the valuation approach to the specific industry context ensures that the assessment accurately reflects the patent’s value within its relevant market and technological landscape, leading to more meaningful and actionable insights.

Update Regularly

The dynamic nature of patent value necessitates regular reassessment using the most current indicator data. Patent value can fluctuate due to various factors, including technological advancements, market shifts, and changes in the competitive landscape. Conducting periodic reviews of patent valuations ensures that the assessments remain accurate and relevant, enabling organizations to make timely and informed decisions regarding their intellectual property assets.

Complement with Other Methods

While indicator-based valuation is a powerful tool, combining it with other valuation approaches can provide a more comprehensive assessment of patent value. Integrating income-based or market-based methods alongside indicator-based analysis offers a multi-faceted view of a patent’s worth. This holistic approach helps capture aspects of value that may not be fully reflected in quantitative indicators alone, resulting in a more robust and well-rounded valuation.

Account for Data Limitations

Acknowledging and addressing limitations in patent databases and potential biases in data collection is crucial for accurate valuations. Being aware of these constraints allows valuators to interpret results more critically and make necessary adjustments. Factoring in these limitations during analysis and interpretation helps prevent overreliance on potentially flawed or incomplete data, leading to more realistic and reliable valuation outcomes.

Incorporate Qualitative Analysis

Supplementing quantitative indicator data with qualitative expert analysis is vital, especially for highly innovative or unique patents. While indicators provide valuable metrics, they may not capture all aspects of a patent’s potential value or strategic importance. Incorporating expert insights and qualitative assessments can offer crucial context and nuance, particularly for patents that may not fit standard valuation models or represent breakthrough technologies.

Stay Informed on Legal and Market Changes

Maintaining awareness of changes in patent laws, market conditions, and technological trends is essential for accurate indicator-based valuations. These external factors can significantly impact patent value and the relevance of certain indicators. Staying informed allows valuators to adjust their methodologies and interpretations accordingly, ensuring that valuations remain relevant and reflective of the current legal and market environment in which the patents operate.

Future Trends in Indicator-Based Patent Valuation

The landscape of indicator-based patent valuation is rapidly evolving, driven by technological advancements and changing business needs. Emerging trends in this field promise to enhance the accuracy, scope, and applicability of patent valuations. These innovations are set to transform how organizations assess, manage, and leverage their intellectual property assets in an increasingly complex and data-driven business environment.

Integration of Big Data

The integration of big data is poised to revolutionize indicator-based patent valuation. As the volume and variety of patent-related data continue to grow, valuation models are expanding to incorporate a wider range of indicators and contextual information. This trend enables more comprehensive and nuanced assessments of patent value, taking into account factors that were previously difficult to quantify or analyze. The incorporation of big data promises to provide deeper insights into patent value, potentially uncovering hidden relationships and patterns that can significantly impact valuation outcomes.

Real-Time Valuation

Advancements in data processing technologies are paving the way for more dynamic and responsive patent valuations. The possibility of real-time or near-real-time updates to patent valuations based on the latest indicator data represents a significant leap forward in the field. This capability would allow organizations to make more timely and informed decisions regarding their patent portfolios, responding quickly to market changes, technological developments, or shifts in the competitive landscape. Real-time valuation could transform patent management from a periodic assessment to an ongoing, adaptive process.

Blockchain for Patent Valuation

The potential application of blockchain technology in patent valuation processes offers exciting possibilities for increased transparency and verifiability. Blockchain could provide a secure and immutable record of patent transactions, licensing agreements, and valuation data. This technology could enhance trust in valuation processes by creating an auditable trail of patent-related activities and assessments. Furthermore, blockchain could facilitate more efficient and transparent patent markets, potentially streamlining licensing negotiations and patent transfers based on verifiable valuation data.

Ecosystem Analysis

Future valuation models are likely to adopt a more holistic approach, considering patents within the context of broader technological ecosystems. This trend recognizes that a patent’s value is not determined in isolation but is influenced by its position and influence within larger innovation networks. Ecosystem analysis could provide insights into a patent’s strategic importance, potential for future development, and synergies with other technologies. This approach may lead to more sophisticated valuations that reflect the interconnected nature of modern innovation landscapes.

Integration with Business Intelligence

The integration of indicator-based patent valuation with broader business intelligence systems represents a significant trend towards more strategic and context-aware valuations. This integration allows organizations to align patent valuations more closely with overall business objectives and market dynamics. By combining patent data with other business metrics and market intelligence, companies can gain a more comprehensive understanding of their intellectual property’s value in relation to their business strategy. This trend promises to make patent valuation a more integral part of strategic decision-making processes across the organization.