Intellectual property👉 Creations of the mind protected by legal rights. (IP) evaluation is a complex process that involves assessing the value and potential of intangible assets like patents, trademarks, copyrights, and trade secrets.

IP valuation is a critical yet challenging aspect of innovation👉 Practical application of new ideas to create value. management and business strategy. It requires a careful balance of quantitative analysis and qualitative judgment, always conducted with an awareness of inherent uncertainties and limitations. By understanding the principles, frameworks, conditions, and constraints of IP evaluation, managers can make more informed decisions about their intellectual property assets. However, it’s important to recognize that IP valuation is not an exact science. It should be viewed as an ongoing process of learning and refinement, always adapted to the specific context and objectives of the organization. As the business environment continues to evolve, so too must the approaches to evaluating and managing intellectual property.

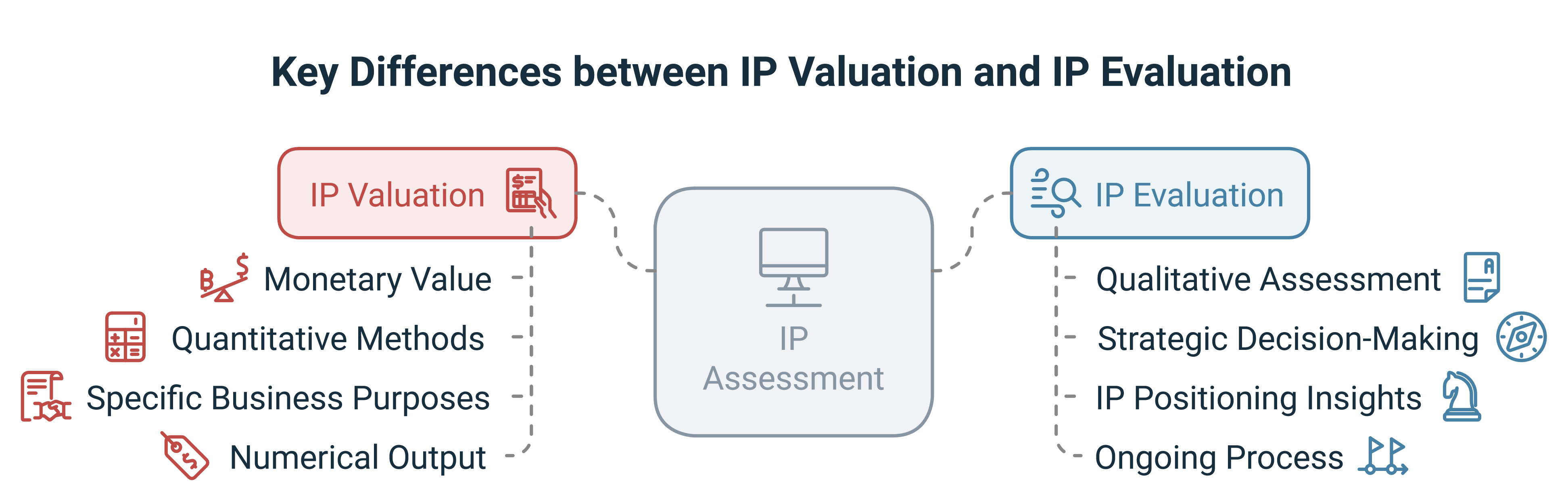

While the terms “IP valuation” and “IP evaluation” are sometimes used interchangeably, there are important distinctions between the two concepts:

The two Concepts: IP Valuation and IP Evaluation

IP Valuation:

- Focuses on determining the monetary value or worth of intellectual property assets

- Aims to assign a specific financial figure to IP, often expressed in currency terms

- Uses quantitative methods like cost, market, and income approaches to calculate value

- Typically conducted for specific business purposes like transactions, licensing👉 Permission to use a right or asset granted by its owner., accounting, etc.

- Results in a numerical valuation amount or range

IP Evaluation:

- Involves a broader assessment of the overall quality, strength, and potential of IP assets

- Examines qualitative factors like legal validity, technological significance, market relevance, etc.

- May not necessarily result in a specific monetary value

- Often used for strategic decision-making, portfolio management👉 Strategic management of diverse assets to optimize returns and balance risk., competitive analysis

- Produces insights on IP positioning, opportunities, and risks

Key differences:

- Scope: Valuation is narrowly focused on monetary worth, while evaluation takes a more holistic view.

- Methods: Valuation relies heavily on financial models and data, while evaluation incorporates more qualitative analysis.

- Output: Valuation produces a numerical figure, evaluation provides strategic insights and recommendations.

- Purpose: Valuation is often for specific transactional needs, evaluation informs broader IP strategy👉 Approach to manage, protect, and leverage IP assets..

- Timing: Valuation provides a snapshot of value at a point in time, evaluation can be an ongoing process.

In practice, a thorough IP assessment often combines elements of both valuation and evaluation to provide a comprehensive understanding of an IP portfolio’s worth and strategic importance. The evaluation process may inform and complement the valuation, while the valuation can provide quantitative support for the qualitative evaluation.

Principles of IP Valuation

IP valuation is a complex and critical process that requires a structured approach to ensure accurate and meaningful results. This chapter explores key principles that underpin effective IP valuation, from rational decision-making👉 Logical process of selecting the best option based on facts and analysis. and uncertainty management to the integration of quantitative and qualitative factors. By understanding these fundamental concepts, IP managers can develop more robust valuation methodologies, navigate the inherent subjectivity of the process, and make informed decisions that align with their organization’s strategic objectives in the dynamic landscape of intellectual property.

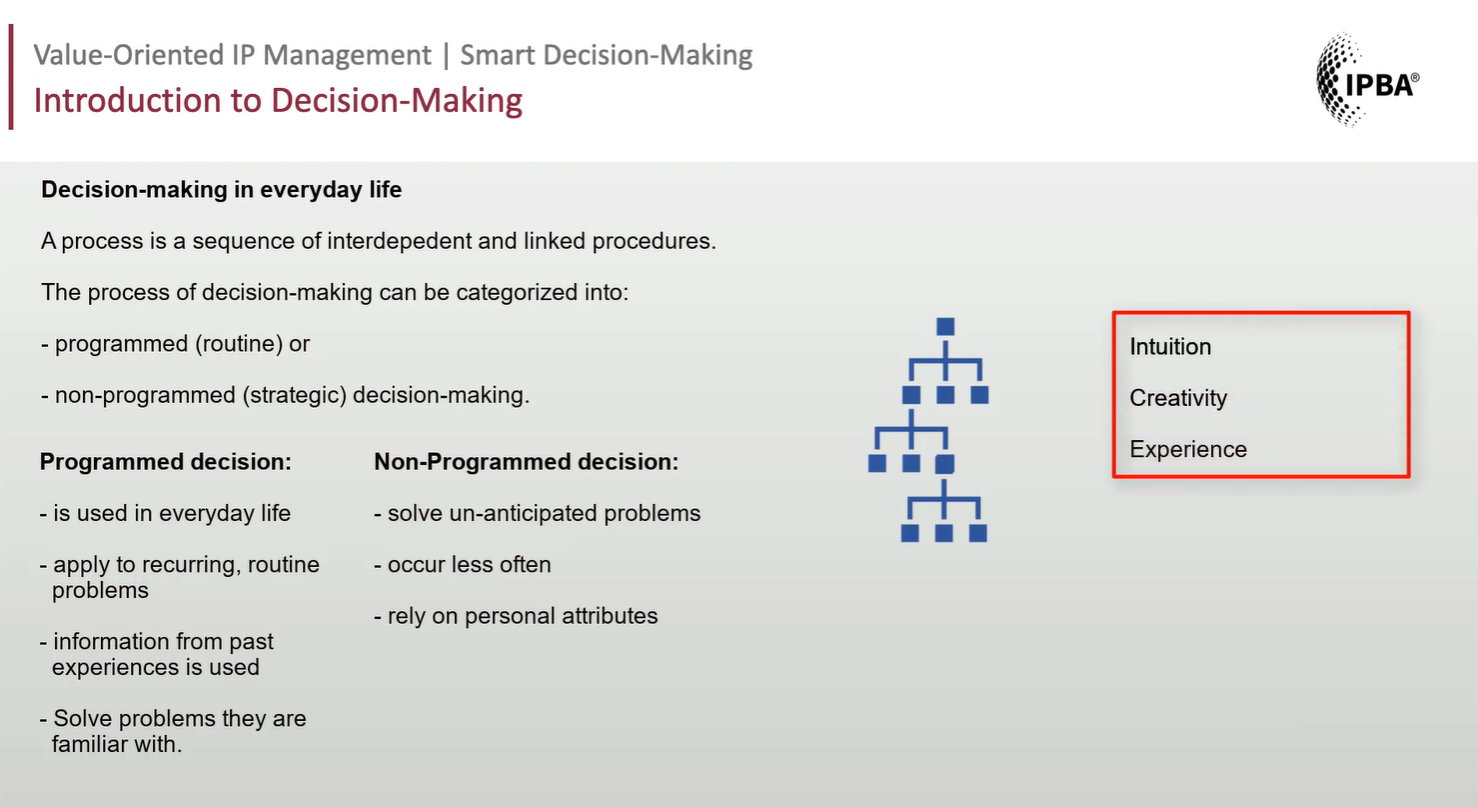

Decision-making is central to IP management and evaluation

IP management👉 Strategic and operative handling of IP to maximize value. revolves around making critical decisions at every stage of the IP lifecycle. These decisions shape the development, protection, commercialization, and enforcement strategies for IP assets. Effective IP managers must cultivate strong decision-making skills to navigate the complex landscape of intellectual property.

Rational decision-making is crucial for effective IP valuation

A structured approach to decision-making is essential for successful IP evaluation. This process involves systematically identifying problems, analysing alternatives, and selecting optimal solutions based on objective data and analysis. By following a rational decision-making framework, IP managers can improve the quality and consistency of their valuations.

IP valuation requires considering uncertainty about the future

The dynamic nature of technology and IP law introduces significant uncertainty into the valuation process. IP managers must make decisions without complete information about future market conditions, technological advancements, or legal changes. Developing strategies to account for and mitigate this uncertainty is a key aspect of effective IP valuation.

There is an important distinction between good decisions and good outcomes in IP evaluation

A well-reasoned decision-making process does not guarantee favourable outcomes in IP management. External factors beyond a manager’s control can influence results, even when the decision-making process is sound. Recognizing this distinction helps IP managers focus on improving their decision-making methodology rather than solely judging decisions based on outcomes.

IP valuation should account for both quantitative and qualitative factors

Effective IP valuation requires a holistic approach that considers both measurable financial metrics and intangible strategic factors. While quantitative data provides important insights, qualitative considerations such as market positioning, competitive advantage, and alignment with business objectives are equally crucial. Balancing these factors leads to more comprehensive and nuanced IP valuations.

The valuation of IP assets often relies on established methods like cost, market, and income approaches

Traditional valuation methods provide a foundation for assessing the worth of IP assets. However, the unique characteristics of intangible assets often necessitate modifications to these approaches. IP managers must adapt and combine valuation techniques to accurately capture the full value of intellectual property in various contexts.

IP valuation is inherently subjective and context-dependent

The value of an IP asset can vary significantly depending on the valuator’s perspective and the specific circumstances. A patent👉 A legal right granting exclusive control over an invention for a limited time. that is highly valuable to one company may have little worth to another due to differences in business models, market positions, or technological capabilities. Recognizing this subjectivity is crucial for conducting thorough and realistic IP valuations.

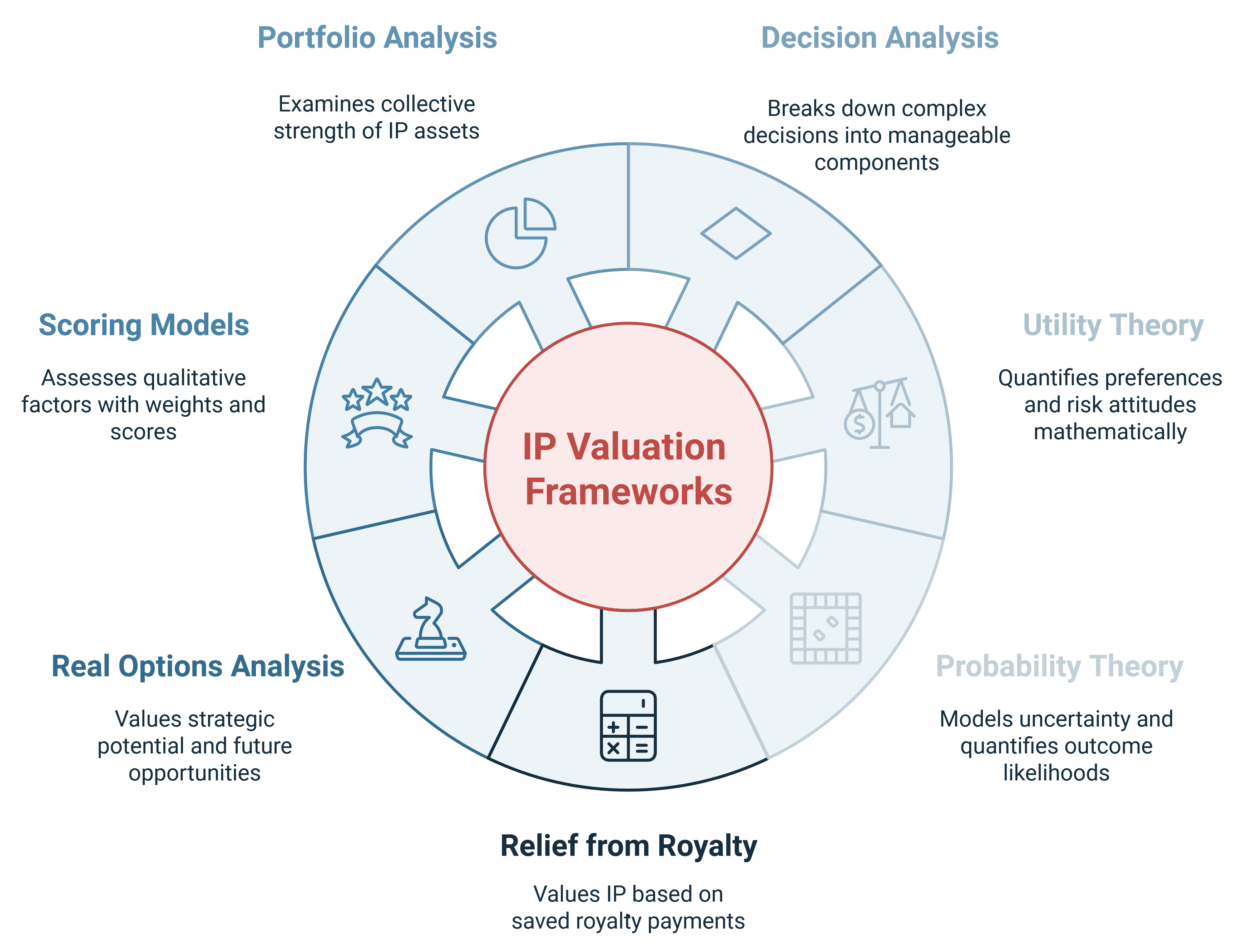

Frameworks for IP Valuation

IP valuation is a complex process that requires sophisticated frameworks to navigate the inherent uncertainties and strategic considerations. This chapter explores key analytical approaches that provide structure and rigor to IP decision-making. From decision analysis and utility theory to probability modeling and portfolio management, these frameworks offer IP managers powerful tools to assess value, quantify risks, and align IP strategies with business objectives. By leveraging these methods, organizations can make more informed and strategic decisions about their intellectual property assets.

Decision Analysis

Decision analysis provides a systematic framework for breaking down complex IP decisions into manageable components. It helps IP managers identify and evaluate different alternatives, clarify objectives, consider external factors, and assess potential outcomes. By structuring the decision-making process, it enables more thorough and rational analysis of IP-related choices.

Utility Theory

Utility theory offers a mathematical approach to quantifying preferences and risk👉 The probability of adverse outcomes due to uncertainty in future events. attitudes in IP decision-making. It allows IP managers to assign numerical values to different outcomes, taking into account both the potential benefits and risks associated with various IP strategies. By providing a more rigorous way to analyze tradeoffs, utility theory can lead to more informed and consistent IP decisions.

Probability Theory

Probability theory is essential for modeling uncertainty in IP valuation, allowing managers to quantify the likelihood of various outcomes. It can be applied to estimate the chances of patent grant, successful commercialization, or potential infringement risks. By incorporating probabilistic thinking, IP managers can make more realistic assessments and better manage risks in their IP strategies.

Relief from Royalty Method

The relief from royalty method is a widely used approach for valuing IP assets based on the royalties saved by owning the IP rather than licensing it. It estimates the hypothetical royalty payments that would be required if the company did not own the IP rights. This method provides a practical way to quantify the economic benefits of IP ownership, especially for assets that are actively used in the business.

Real Options Analysis

Real options analysis views IP rights as options to exploit future opportunities, similar to financial options. This framework allows for the valuation of flexibility and strategic potential inherent in IP assets. By considering the value of future decision rights, real options analysis can capture the strategic value of IP that might be overlooked by traditional valuation methods.

Scoring Models

Scoring models offer a structured approach to assessing qualitative factors in IP valuation by assigning weights and scores to different criteria. They allow IP managers to incorporate subjective judgments and expert opinions into the evaluation process in a systematic way. By providing a quantitative output based on qualitative inputs, scoring models can facilitate comparison and ranking of different IP assets or strategies.

Portfolio Analysis

Portfolio analysis takes a comprehensive view of a company’s IP assets, examining how they interact and support overall business strategy. It helps managers understand the collective strength and weaknesses of their IP portfolio, rather than focusing on individual assets in isolation. By aligning IP portfolio management with business objectives, this approach can lead to more strategic decision-making and resource allocation in IP management.

Conditions for Effective IP Evaluation

Effective IP evaluation is a complex process that requires careful consideration of multiple factors to ensure accurate and meaningful results. This chapter explores the key conditions necessary for conducting robust IP evaluations, from setting clear objectives to employing multiple evaluation methods. By understanding and implementing these essential elements, IP professionals can enhance the reliability and relevance of their evaluations, providing stakeholders with valuable insights for informed decision-making in the dynamic landscape of intellectual property management.

Clear Objectives

Defining clear objectives is crucial for effective IP evaluation, as it guides the entire process and determines the appropriate methodologies to be used. The purpose of the evaluation, whether for transactions, financial reporting, litigation, or internal strategy, significantly influences the approach and level of detail required. Having well-defined objectives ensures that the evaluation results are relevant and actionable for the intended use.

Sufficient Information

Gathering comprehensive and accurate data on the IP asset, relevant markets, and comparable transactions is essential for a reliable evaluation. The quality and completeness of information directly impact the accuracy and credibility of the evaluation results. Sufficient information allows evaluators to make informed judgments and reduces uncertainty in the valuation process.

Appropriate Expertise

Effective IP evaluation requires a multidisciplinary approach, combining legal, technical, and business expertise to fully assess an asset’s potential. Legal expertise is necessary to understand the scope and strength of IP rights, technical knowledge helps in assessing the innovation’s value proposition, and business acumen is crucial for evaluating market potential and strategic fit. The integration of these diverse skill sets ensures a comprehensive and nuanced evaluation of the IP asset.

Consideration of Context

The value of IP can fluctuate significantly based on factors such as the holder’s capabilities, industry dynamics, and strategic fit within an organization. Understanding the specific context in which the IP exists is crucial for accurately assessing its value and potential. Evaluators must consider how the IP aligns with the holder’s business model👉 A business model outlines how a company creates, delivers, and captures value., market position, and overall strategy to provide a meaningful valuation.

Forward-Looking Perspective

IP evaluation must go beyond historical performance and focus on the future potential of the asset. This forward-looking approach involves analyzing market trends, technological advancements, and potential applications of the IP. By considering future scenarios and growth opportunities, evaluators can provide a more accurate assessment of the IP’s long-term value and strategic importance.

Risk Assessment

A comprehensive risk assessment is vital for effective IP evaluation, encompassing legal challenges, technological obsolescence, and market changes. Evaluators must consider potential infringement risks, the likelihood of invalidation, and the impact of emerging technologies on the IP’s value. A thorough risk analysis provides a more realistic valuation and helps stakeholders understand the potential vulnerabilities associated with the IP asset.

Multiple Methods

Employing multiple evaluation approaches and reconciling their results enhances the robustness and reliability of IP evaluation. Different methods, such as cost, market, and income approaches, can provide diverse perspectives on the IP’s value. By comparing and reconciling the results from various methodologies, evaluators can identify potential biases, validate assumptions, and arrive at a more comprehensive and defensible valuation.

Limitations and Constraints in IP Evaluation

IP evaluation is a challenging process fraught with numerous limitations and constraints. This chapter explores the key obstacles faced by IP managers and evaluators when assessing the value and potential of IP assets. From inherent uncertainties and lack of comparable data to cognitive biases and legal complexities, these challenges can significantly impact the accuracy and reliability of IP evaluations. Understanding these limitations is crucial for developing robust evaluation strategies and making informed decisions in the dynamic landscape of intellectual property management.

Uncertainty

The future value of intellectual property (IP) is inherently uncertain, particularly for new technologies and in rapidly evolving markets. This uncertainty stems from unpredictable changes in technology, consumer preferences, and regulatory environments that can significantly impact the potential success and profitability of IP assets. Consequently, IP managers must incorporate strategies to manage and mitigate these uncertainties when evaluating the value and potential of their IP portfolios.

Lack of Comparable Data

Unlike tangible assets, finding truly comparable transactions for IP can be challenging, which limits the reliability of market-based valuations. This difficulty arises because IP assets are often unique, lacking direct equivalents in the market that can serve as benchmarks for valuation. As a result, evaluators may need to employ alternative methods or rely on expert judgment to estimate the value of IP assets accurately.

Subjectivity

Many aspects of IP evaluation involve subjective judgments, such as assessing technical merit and estimating market potential. These subjective elements can lead to variations in valuation outcomes depending on the evaluator’s expertise, assumptions, and biases. To address this challenge, it is important to use a structured approach that incorporates multiple perspectives and methodologies to enhance objectivity and consistency in IP evaluations.

Cognitive Biases

Decision-makers are prone to various cognitive biases that can skew IP evaluations, including overconfidence, confirmation bias, and loss aversion. These biases can lead to overly optimistic valuations or an underestimation of risks associated with IP assets. Recognizing and mitigating these biases through structured decision-making processes and diverse team inputs can improve the accuracy and reliability of IP evaluations.

Legal Complexities

Assessing the strength and enforceability of IP rights can be difficult, especially across different jurisdictions with varying legal standards and practices. Legal complexities such as differences in patent laws, trademark👉 A distinctive sign identifying goods or services from a specific source. protections, and enforcement mechanisms can affect the perceived value and risk associated with IP assets. Evaluators must stay informed about relevant legal frameworks and consider these factors when determining the value of IP.

Rapidly Changing Environment

Technological advances and market shifts can quickly alter the value of IP assets, making it challenging to predict long-term worth accurately. Innovations can render existing technologies obsolete or create new opportunities that enhance an asset’s value. Therefore, ongoing monitoring of technological trends and market dynamics is essential for maintaining accurate valuations over time.

Resource Constraints

Thorough IP evaluation can be time-consuming and expensive, often requiring significant investment in data collection, analysis, and expert consultations. These resource constraints may lead to trade-offs between the depth of analysis and practicality, potentially affecting the comprehensiveness of the evaluation. Balancing these constraints while ensuring a robust evaluation process is crucial for effective IP management.

Interdependencies

The value of IP often depends on complementary assets👉 Resources that enhance the value of innovations when combined. and capabilities, making isolated evaluation challenging. For example, a patent may require specific manufacturing capabilities or distribution networks to realize its full economic potential. Understanding these interdependencies is vital for accurately assessing an asset’s overall value within a broader business context.

Difficulty in Forecasting

Projecting future cash flows from IP, especially for early-stage technologies, involves significant speculation due to uncertainties in market adoption rates and competitive responses. Accurate forecasting requires careful analysis of market trends, consumer behaviour, and technological advancements. Employing scenario analysis and sensitivity testing can help address these uncertainties in valuation models.

Accounting and Regulatory Limitations

Financial reporting standards may not fully capture the strategic value of IP assets due to limitations in recognizing intangible benefits such as brand👉 A distinctive identity that differentiates a product, service, or entity. strength or competitive advantage. Regulatory frameworks often focus on quantifiable metrics that may overlook qualitative aspects critical to an asset’s true worth. Navigating these limitations requires a comprehensive approach that integrates both financial metrics and strategic considerations into IP valuation practices.

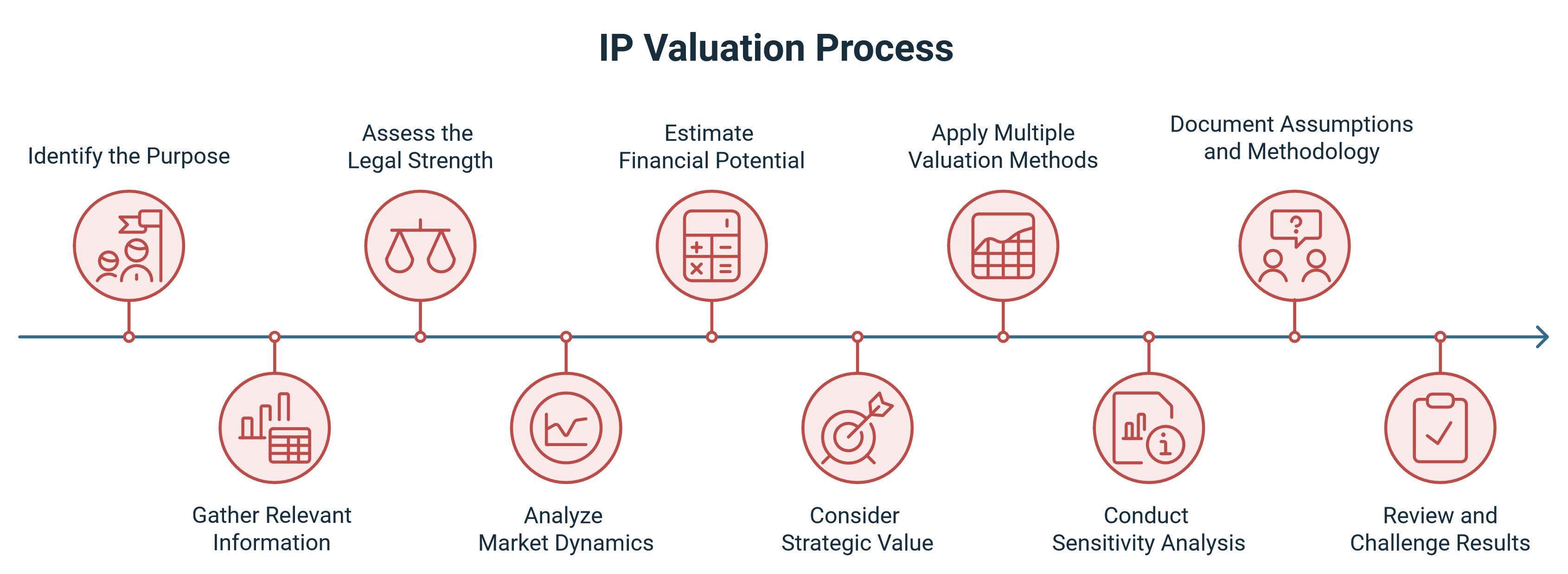

Key Considerations in IP Valuation Process

IP valuation is a critical process that requires a structured approach to ensure accurate and meaningful results. This chapter outlines key considerations essential for conducting a comprehensive IP valuation. From defining the purpose and gathering relevant information to assessing legal strength and market dynamics, each step plays a vital role in determining an IP asset’s true value. By following these guidelines, IP professionals can navigate the intricacies of valuation, considering both financial and strategic aspects, while maintaining transparency and defensibility throughout the process.

Identify the Purpose

Clearly defining the purpose of the IP valuation is crucial as it shapes the entire evaluation process. The purpose, whether for transactions, financial reporting, litigation, or internal strategy, determines the appropriate methodologies and level of detail required. A well-defined purpose ensures that the valuation results are relevant and actionable for the intended use.

Gather Relevant Information

Comprehensive data collection is essential for an accurate IP valuation, encompassing legal, technical, and market-related information. This includes gathering details on the IP asset’s legal status, technical specifications, market potential, and any relevant historical data. Thorough information gathering provides a solid foundation for the valuation process and helps reduce uncertainty in the assessment.

Assess the Legal Strength

Evaluating the legal strength of the IP rights is critical in determining their overall value and enforceability. This assessment involves examining the scope of protection, remaining life of the IP rights, and the likelihood of successful enforcement against potential infringers. A strong legal position generally enhances the value of the IP asset, while weaknesses may significantly reduce its worth.

Analyze Market Dynamics

A thorough analysis of market dynamics is crucial for understanding the potential value of the IP asset in its competitive landscape. This involves studying industry trends, assessing the competitive environment, and identifying potential applications or markets for the technology. Understanding these factors helps in estimating the IP’s future economic potential and its strategic importance in the market.

Estimate Financial Potential

Projecting the financial potential of the IP asset is a key step in quantifying its value. This involves forecasting potential revenues, cost savings, or other economic benefits that can be directly attributed to the IP. Accurate financial projections require a deep understanding of the market, the technology’s capabilities, and realistic assumptions about its future performance.

Consider Strategic Value

Assessing the strategic value of IP goes beyond immediate financial returns to consider its long-term impact on the business. This involves evaluating how the IP fits into the company’s broader business strategy and its potential to create sustainable competitive advantages. Strategic value assessment often includes factors like market positioning, technology leadership, and potential for future innovations.

Apply Multiple Valuation Methods

Using a combination of valuation approaches provides a more comprehensive and robust assessment of the IP’s value. This typically involves applying cost, market, and income approaches to triangulate a value range. By comparing results from different methods, valuators can identify discrepancies and arrive at a more reliable valuation estimate.

Conduct Sensitivity Analysis

Sensitivity analysis is crucial for understanding how changes in key assumptions affect the valuation outcome. This involves testing various scenarios by adjusting important variables such as market size, growth rates, or discount rates. Conducting thorough sensitivity analysis helps in identifying the most critical factors influencing the IP’s value and provides insight into the range of possible outcomes.

Document Assumptions and Methodology

Clear documentation of all assumptions, methodologies, and data sources used in the valuation process is essential for transparency and defensibility. This documentation should provide a detailed explanation of how conclusions were reached and why certain approaches were chosen. Thorough documentation not only supports the credibility of the valuation but also allows for future review and adjustment if needed.

Review and Challenge Results

Critical examination of the valuation results and seeking diverse perspectives are crucial final steps in the IP valuation process. This involves reviewing the outcomes for consistency and reasonableness, and potentially seeking input from experts in different fields. Challenging the results helps identify potential blind spots or biases in the valuation, leading to a more robust and reliable assessment of the IP’s value.

Improving IP Valuation Practices

In today’s dynamic business environment, organizations must continuously refine and enhance their IP valuation practices to ensure accurate assessments and strategic decision-making. This chapter explores key strategies and best practices for improving IP valuation processes, from standardization and technological integration to collaboration and continuous learning. By implementing these improvements, organizations can develop more robust and reliable IP valuation capabilities.

Develop Standardized Processes

Implementing consistent frameworks across an organization ensures uniformity and reliability in IP evaluations. Standardized processes help reduce subjective variations and enable meaningful comparisons between different IP assets. These frameworks should be flexible enough to accommodate different types of IP while maintaining consistency in evaluation criteria and methodologies.

Leverage Data and Analytics

Modern data analytics and AI technologies offer powerful tools for enhancing IP valuation accuracy and efficiency. These technologies can process vast amounts of market data, identify patterns, and generate more precise valuations based on historical and current information. Advanced analytics also help predict future trends and market developments that may impact IP value.

Foster Cross-Functional Collaboration

Bringing together diverse expertise ensures comprehensive evaluation of IP assets from multiple perspectives. Cross-functional teams can identify potential applications, risks, and opportunities that might be overlooked by a single department. Regular collaboration between different departments helps create a more holistic understanding of IP value and its strategic implications.

Implement Regular Reviews

Periodic reassessment of IP valuations helps maintain accuracy in light of changing market conditions. Regular reviews enable organizations to identify emerging opportunities or risks that might affect IP value. This practice ensures that IP portfolio management remains aligned with current business objectives and market realities.

Invest in Training

Continuous education and skill development are essential for maintaining high-quality IP evaluation practices. Training programs should cover both technical valuation methodologies and strategic considerations in IP management. Regular exposure to industry best practices helps evaluators stay current with evolving valuation techniques and market trends.

Utilize External Expertise

External specialists can provide valuable insights and objective perspectives on complex IP valuations. Professional valuators bring specialized knowledge and experience from diverse industries and situations. Their involvement can enhance the credibility and reliability of high-stakes valuations.

Develop Scenario Planning

Scenario analysis helps organizations prepare for different possible futures and their impact on IP value. This approach enables better risk management👉 Process of identifying, assessing, and controlling threats to assets and objectives. and more robust valuation assessments. Multiple scenario planning helps identify potential opportunities and threats that might affect IP value over time.

Improve Documentation

Thorough documentation of evaluation processes creates a valuable knowledge base for future reference. Detailed records help maintain consistency and enable continuous improvement of valuation practices. Good documentation also supports knowledge transfer and training of new evaluation team members.

Align Incentives

Creating appropriate reward systems encourages honest and accurate IP valuations. Well-designed incentives help prevent bias towards overly optimistic or pessimistic assessments. Alignment of incentives with long-term organizational goals promotes more objective and reliable valuations.

Learn from Experience

Post-mortem analyses of past IP decisions provide valuable insights for improving future evaluations. Regular review of successes and failures helps identify areas for improvement in valuation processes. Learning from experience enables organizations to continuously refine their approach to IP valuation.