Intellectual property (IP) valuation has become increasingly important in the modern business landscape, reflecting a shift in perspective from viewing IP solely as a legal matter to recognizing it as a valuable economic asset. This change was driven by court decisions in the 1980s and academic discussions on the economic use of IP. As companies began to develop licensing programs for their unused IP, the need for sound valuation procedures grew, correlating with the emergence of new business models based on intellectual property.

Several standards have been developed to address the complexities of IP valuation, particularly focusing on patents and brands. These standards provide structured approaches to valuing these complex assets, balancing the need for standardization with the recognition that each valuation case is unique.

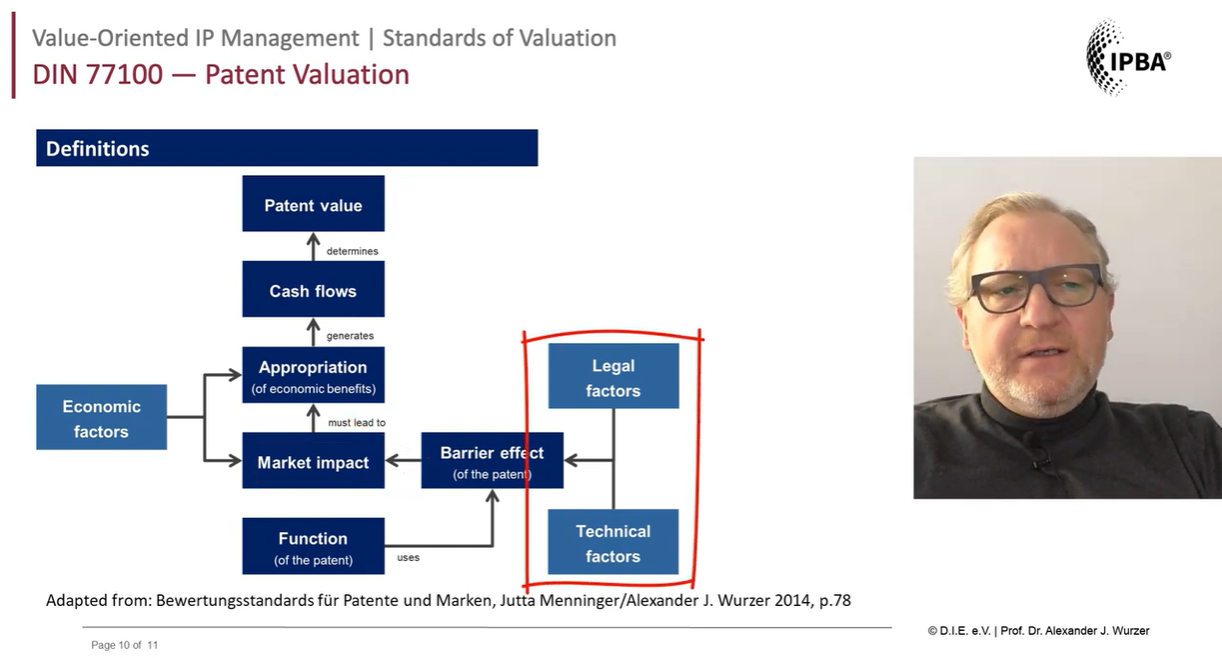

DIN 77100 Patent Valuation

One key standard is DIN 77100, which focuses on patent valuation. This standard defines patent value as the expected future financial benefit from exploiting a patent relative to the valuation date. It emphasizes that patent value arises from economic exploitation, which occurs within a specific exploitation scenario. The standard recognizes that a patent per se cannot be valuated; only a patent that is used in a concrete exploitation scenario can be assessed.

DIN 77100 outlines a hierarchical structure for practical valuation with four preference stages: the cause of valuation, the quality of information, the valuation approach, and the valuation method. The income approach is preferred, as it considers the patent value as future benefit. Within this approach, the excess earnings method and license analogy are the primary methods used to determine patent value.

The standard also emphasizes the importance of considering complementary goods, which are necessary for patent exploitation. The value of the patent must be clearly separated from the value of these complementary goods. Additionally, DIN 77100 addresses the valuation of patent portfolios, recognizing that usually multiple patents are involved in an exploitation scenario.

Factors influencing patent valuation include technical, legal, and economic aspects. These factors affect the patent’s barrier effect, market impact, and appropriation by the owner. The standard provides an impact scheme detailing how patent function generates cash flow and ultimately patent value. DIN 77100 also specifies basic conditions for valuation, including the date principle, requirements for expert valuators, and guidelines for valuation reports. It emphasizes the need for transparency in the use of all valuation criteria and ease of understanding for non-experts.

ISO10668 Brand Valuation

Another significant standard is ISO 10668, which focuses on brand valuation. This standard defines a brand as an intangible asset that makes products, services, or legal entities recognizable and differentiable. It distinguishes between brands, trademarks, and tradenames.

ISO 10668 allows three main valuation approaches: the income approach, the market approach, and the cost approach. The income approach is based on future payment streams and can use methods such as price-premium, volume-premium, profit-split, residual-value, incremental cash flow, and license analogy. The market approach uses market prices of comparable brands but is often impractical due to the rarity of brand transactions. The cost approach considers past costs for brand reproduction or replacement and is used when other approaches are not applicable.

The standard emphasizes the importance of transparent and well-documented information, including market and financial data. It also stresses the use of behavioral economic methods in brand valuation. Factors influencing brand value include brand strength, brand status, brand loyalty, and brand awareness. ISO 10668 outlines six general criteria for brand valuation: transparency, validity, reliability, sufficiency, objectivity, and consideration of financial, behavioral theoretic, and legal criteria. The standard requires that the valuation report include detailed information about the valuation process, assumptions, and limitations.

Commonalities of the standards

Both standards emphasize the importance of considering the specific context of the valuation, including the purpose, available information, and the unique characteristics of the asset being valued. They focus on future economic benefits as the primary source of value for intellectual property and intangible assets.

The standards also stress the need for transparent processes and comprehensive documentation of all assumptions, methods, and data used in the valuation. While income-based approaches are generally preferred, the standards acknowledge that different situations may require different valuation methods, including market-based and cost-based approaches.

The valuation of intellectual property and intangible assets is recognized as an interdisciplinary task, requiring expertise in legal, economic, and technical aspects. All standards emphasize the importance of considering and quantifying risks associated with the asset being valued.

As businesses increasingly rely on intellectual property and intangible assets for value creation, these valuation standards serve as crucial tools for financial reporting, strategic decision-making, and transactions involving these assets. They highlight the evolving nature of asset valuation in a knowledge-based economy, where traditional physical assets may play a diminishing role compared to intangible ones.

The detailed guidelines provided by these standards underscore the complexity of valuing intellectual property and brands. They require valuators to have a deep understanding of not only financial principles but also the specific technical, legal, and market contexts in which these assets operate. This multifaceted approach ensures that the resulting valuations provide a more accurate and comprehensive picture of an asset’s true worth in its relevant economic and strategic context.

The development of these standards reflects the growing importance of intellectual property and intangible assets in the modern economy. They provide a structured approach to valuing these complex assets, aiming to ensure that valuations are conducted in a thorough, transparent, and defensible manner, considering all relevant factors and potential future scenarios.

In practice, the application of these standards requires careful consideration of various factors. For patent valuation, the valuator must analyze the concrete blocking function of a patent which is causing the cash flow. There must be a clear causality between the revenue through the cash flow and the prohibitive right of the valuated patent.

The useful life of the patent is another crucial factor. This refers to the economic useful life, which is generally shorter than the technological or legal useful life. It may end when the maximum protection period of the patent protection expires, or when complementary goods are no longer available.

Risk factors, such as the legal status of a patent application, must also be considered. The probability of these influencing factors has to be accounted for in the patent valuation. Taxes are treated in the valuation like negative cash flows, as cash flows generated by patents are generally taxable.

For brand valuation, the standards emphasize the need to quantify the monetary part of the brand and to determine the discount rate depending on the brand risk. The direct effect of the brand on the customer is determined either by a price premium or a volume premium – the effect of a brand that causes either a higher price or higher volumes of sold products and services compared to unbranded products and services.

Methods to determine these premiums include the panel method, where purchasing prices are compared (typically for fast-moving consumer goods), or the choice-based conjoint analysis, which analyzes all factors making a product or service attractive to customers.

Other influencing factors for brand valuation include brand strength, brand status, and brand loyalty. Brand strength is necessary to determine the risk of a brand, while brand status is needed to determine the potential of a brand to justify premium prices. Brand loyalty describes the relationship of a long-term customer with a brand, with indicators including the continuity of purchasing the brand and satisfaction with it.

The standards also highlight the importance of brand awareness – the extent to which customers are aware of the category of the branded product or service when they see the brand. This awareness supports brand loyalty and contributes to the overall value of the brand.

International Valuation Standard IVS

The International Valuation Standards (IVS) provide a comprehensive framework for valuing various assets, including intellectual property (IP). For IP valuation, the IVS offers guidance through its General Standards and specific Asset Standards, particularly IVS 210, which focuses on Intangible Assets. The International Valuation Standards provide a crucial framework for IP valuation, promoting consistency and reliability in this complex field. By adhering to these standards, valuers can ensure that their IP valuations are robust, transparent, and defensible.

As the global economy becomes increasingly knowledge-based, the importance of accurate IP valuation continues to grow. The IVS framework, with its emphasis on thorough analysis, appropriate methodologies, and clear reporting, plays a vital role in supporting informed decision-making in IP transactions, financial reporting, and strategic management.

For professionals involved in IP valuation, a deep understanding of the IVS, particularly IVS 210, is essential. As the landscape of intangible assets continues to evolve, staying updated with the latest developments in IVS will be crucial for delivering high-quality, reliable IP valuations that meet global standards and best practices.

Overview of IVS for IP Valuation

The IVS framework for IP valuation is designed to ensure consistency, transparency, and reliability in valuation practices worldwide. It recognizes the unique characteristics of IP assets and provides guidance on how to address these in the valuation process.

General Standards Application to IP

The five General Standards (IVS 101-105) set the foundation for all valuation assignments, including IP:

- IVS 101 Scope of Work: This standard emphasizes the importance of clearly defining the terms of engagement for an IP valuation. For IP assets, this includes specifying the exact rights being valued, such as patents, trademarks, or copyrights.

- IVS 102 Investigations and Compliance: When valuing IP, this standard requires thorough investigation into the legal rights, protection status, and any potential infringements or disputes related to the IP.

- IVS 103 Reporting: The valuation report for IP must clearly communicate the scope, key assumptions, and methods used in the valuation process.

- IVS 104 Bases of Value: For IP, the basis of value could vary depending on the purpose of the valuation. Market value, fair value, or investment value might be used depending on the context.

- IVS 105 Valuation Approaches and Methods: This standard outlines the main approaches (market, income, and cost) that can be applied to IP valuation.

IVS 210: Intangible Assets

IVS 210 is particularly relevant for IP valuation as it provides specific guidance for intangible assets, including IP. Key aspects of this standard include:

Definition and Categorization

IVS 210 defines intangible assets and categorizes different types of IP, such as patents, trademarks, copyrights, and trade secrets. It emphasizes the importance of understanding the specific characteristics of each IP type.

Valuation Approaches

The standard discusses the application of the three main valuation approaches to IP:

- Market Approach: This can be challenging for IP due to the unique nature of many IP assets. However, it may be applicable for certain types of IP where comparable market transactions exist.

- Income Approach: Often the most relevant for IP valuation, this approach considers the future economic benefits expected from the IP. Methods include relief-from-royalty, premium profits, and excess earnings.

- Cost Approach: While less common for IP valuation, this approach may be relevant for easily replicable IP or when the economic benefits are difficult to quantify.

Specific Considerations for IP

IVS 210 highlights several factors that valuers must consider when assessing IP:

- Legal rights and protection: The strength and duration of legal protection significantly impact IP value. Valuers must assess factors such as the scope of patent claims, the geographic coverage of trademarks, and the robustness of copyright or trade secret protections to determine the asset’s legal defensibility and potential longevity.

- Economic benefits: The ability of the IP to generate future economic benefits is crucial. This involves analyzing potential revenue streams, cost savings, market share improvements, or competitive advantages that the IP can provide over its expected useful life.

- Remaining useful life: This includes both legal life and economic life of the IP. While legal life is often clearly defined (e.g., patent expiration dates), economic life may be shorter due to technological obsolescence or market changes, requiring careful assessment of future relevance and competitiveness.

- Stage of development: For patents or technologies, the stage of development affects value. Early-stage technologies may have higher risk but also greater potential for value appreciation, while mature technologies might offer more predictable cash flows but limited growth prospects.

- Highest and best use: Considering how the IP could be optimally utilized is essential in determining its true value. This may involve exploring potential applications in different industries, assessing licensing opportunities, or evaluating strategic partnerships that could maximize the IP’s economic potential.

Practical Implementation of IVS in IP Valuation

- Clearly define the IP asset being valued, including all associated rights:

The first step in IP valuation is to precisely identify and describe the asset, including its legal classification (e.g., patent, trademark, copyright) and all associated rights. This definition should encompass the scope of protection, any limitations or restrictions, and any ancillary rights that may affect the asset’s value. - Determine the appropriate basis of value based on the purpose of the valuation:

The valuer must establish the appropriate basis of value, such as market value, fair value, or investment value, depending on the valuation’s purpose and context. This determination is crucial as it influences the valuation approach and the interpretation of the results. - Gather comprehensive information about the IP, including legal status, market conditions, and potential economic benefits:

This step involves conducting thorough due diligence to collect all relevant information about the IP asset, including its legal status, protection strength, and any ongoing disputes or infringements. It also requires analyzing market conditions, competitive landscape, and potential future economic benefits derived from the IP. - Select and apply appropriate valuation methods, considering the unique characteristics of the IP:

Based on the IP’s nature and the available information, the valuer should choose suitable valuation methods from the income, market, and cost approaches. The selection should reflect the IP’s unique characteristics, such as its stage of development, market potential, and the availability of comparable transactions. - Document assumptions, limitations, and key inputs used in the valuation process:

Thorough documentation of all assumptions, limitations, and key inputs is essential for transparency and credibility of the valuation. This includes clearly stating any market assumptions, growth projections, discount rates, and other critical factors that influence the valuation outcome. - Prepare a detailed report that complies with IVS 103 reporting requirements:

The final step is to compile a comprehensive valuation report that adheres to the IVS 103 reporting standards, ensuring clarity, transparency, and sufficient detail for the intended users to understand the valuation process and results. This report should include all relevant information, methodologies used, key assumptions, and a clear presentation of the valuation conclusion.

Challenges in Applying IVS to IP Valuation

While the IVS provides a robust framework, IP valuation presents unique challenges:

- Lack of comparable market data: Many IP assets are unique, making market comparisons difficult.

- Uncertainty in future benefits: Predicting the economic benefits of IP can be highly speculative.

- Rapid technological changes: This can quickly impact the value of certain types of IP.

- Bundle rights: IP often comes in bundles, making it challenging to value individual components.