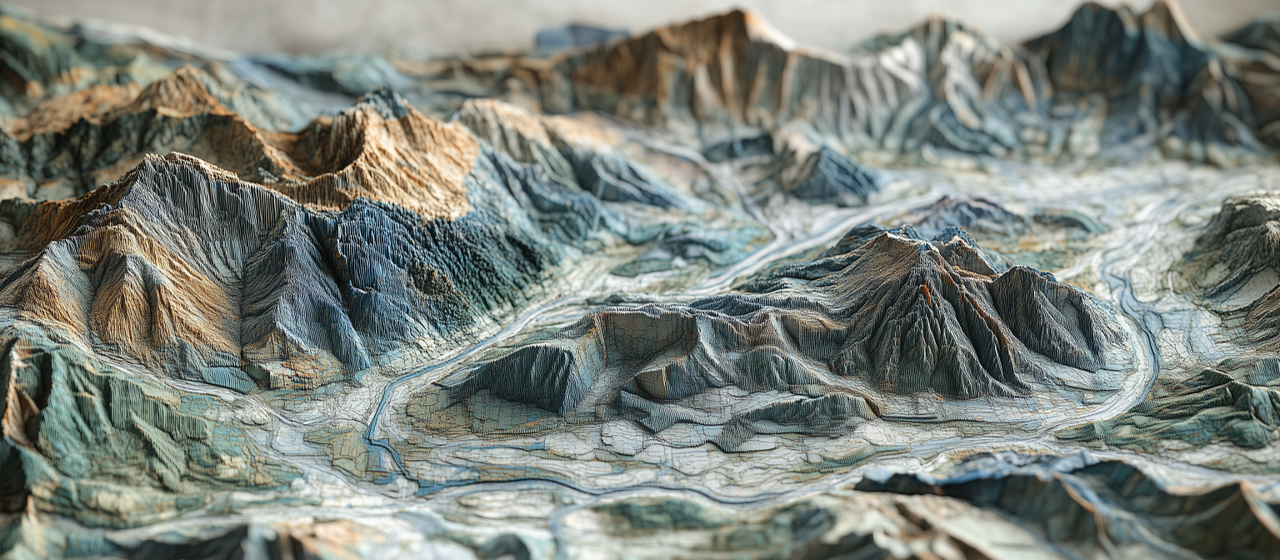

Mapping the IP Terrain

“Mapping the IP Terrain” is a fantastic way to visualize and understand the competitive landscape through the lens of intellectual property. It’s like creating a map of who owns what in the world of inventions, brands, and creative works.

Identify Key Players

Mapping the IP terrain starts with identifying the key players who own and control the relevant intellectual property. This includes your direct competitors, of course, but also consider emerging startups, research institutions, and even universities that might hold valuable patents or other IP. Don’t forget about non-practicing entities (NPEs), sometimes called “patent trolls,” who acquire patents for licensing or litigation rather than product development. Understanding who owns what IP in your industry is crucial for assessing competitive threats, identifying potential partners, and making informed strategic decisions.

Patent Portfolio Analysis

Once you’ve identified the key players, it’s time to analyze their patent portfolios. This involves diving into patent databases like Patstat, Derwent Innovation, and Google Patents to gather information on the patents they hold. Look at the number of patents, the technologies they cover, and how those patents are interconnected through citations. Analyze the quality of their patents, considering factors like claim scope, family size, and citation impact. This analysis reveals each player’s strengths and weaknesses, their R&D focus, and their potential for innovation.

Geographic Coverage

Mapping the IP terrain also involves understanding the geographic distribution of patents. Where are your competitors seeking patent protection? Are they focused on specific countries or regions? This can reveal their target markets, their global ambitions, and potential areas of competition. Analyzing geographic coverage can support your own patenting strategy, helping you decide where to file patents to maximize your market reach and protect your inventions in key jurisdictions. Tools like patent maps can visualize this geographic distribution, making it easier to identify patterns and opportunities.

Assessing Competitive Strengths and Weaknesses

Assessing competitive strengths and weaknesses is a core component of IP benchmarking. It’s about understanding where you stand in the IP landscape relative to your rivals.

Qualitative and Quantitative Analysis

Assessing competitive strengths and weaknesses requires a multifaceted approach that combines both quantitative and qualitative analysis. Quantitative analysis involves measuring and comparing objective metrics, such as patent counts, citation impact, and geographic coverage. This provides a data-driven overview of the IP landscape and helps identify areas where you might be ahead or behind the competition. However, numbers alone don’t tell the whole story. Qualitative analysis adds depth and nuance by considering factors like the strength and scope of patent claims, the commercial relevance of inventions, and the alignment of IP with business strategy. This holistic approach provides a more comprehensive understanding of the competitive landscape and allows for a more nuanced assessment of IP strengths and weaknesses.

Benchmarking Key Metrics

Benchmarking key metrics are essential for understanding your competitive position. This involves comparing your IP portfolio against those of your competitors using relevant metrics. For example, you might compare the number of patents, the average number of claims per patent, the frequency of forward citations, or the geographic coverage of your patents. By benchmarking these metrics, you can identify areas where you have a competitive advantage, as well as areas where you may need to improve. This data-driven approach helps you make informed decisions about R&D investments, patent filings, and overall IP strategy.

Identifying "White Spots"

Identifying “white spots” is a crucial aspect of competitive analysis. These are areas of technology or innovation where there is limited IP activity. White spots can represent untapped opportunities for your company to innovate and gain a first-mover advantage. By analyzing patent landscapes and technology trends, you can identify white spots and strategically align your R&D efforts to capitalize on these opportunities. This proactive approach can help you establish a strong IP position in emerging fields and gain a competitive edge in the marketplace.

Understanding Competitors’ Strategies

Understanding your competitors’ strategies is very beneficial in the business world. IP benchmarking provides the tools to decipher those strategies, giving you a significant advantage.

R&D Focus

Analyzing competitors’ patent filings reveals their R&D priorities. Are they focused on incremental improvements to existing technologies or pursuing disruptive innovations? Are they investing heavily in specific areas, indicating a strategic commitment to those technologies? Understanding their R&D focus allows you to anticipate their future products and services, identify potential “white spots” in the market, and adjust your own R&D strategy accordingly.

Licensing and Enforcement Activity

Tracking competitors’ licensing and enforcement activities provides valuable intelligence. Are they actively licensing their patents to generate revenue or building a defensive patent thicket to block competitors? Are they aggressively enforcing their patents through litigation, or are they more collaborative in their approach? This information can inform your own licensing and enforcement strategies and help you assess the risk of potential patent disputes.

M&A Activity

Monitoring mergers and acquisitions involving IP assets can reveal significant shifts in the competitive landscape. Are your competitors acquiring companies to gain access to key technologies or eliminate potential rivals? Are they divesting certain IP assets, suggesting a change in their strategic direction? Tracking M&A activity can help you identify potential acquisition targets or partners and stay ahead of emerging competitive threats.