A patent👉 A legal right granting exclusive control over an invention for a limited time. portfolio is a collection of patents owned by an organization. Patent portfolio analysis is a strategic tool used to evaluate and manage these patents. It involves assessing the quality, value, and strategic importance of patents within the portfolio. The analysis helps organizations make informed decisions about patent maintenance, licensing👉 Permission to use a right or asset granted by its owner., acquisition, and abandonment to optimize the portfolio’s value and align it with business objectives.

The evolution of patent portfolio management👉 Strategic management of diverse assets to optimize returns and balance risk. from its roots in business portfolio analysis reflects the growing strategic importance of intellectual property👉 Creations of the mind protected by legal rights.. What began as simple frameworks for visualizing business units has developed into sophisticated systems for managing patent assets as a key source of competitive advantage.

This evolution has been driven by the increasing value of intangible assets in the knowledge economy, as well as advances in data analytics and strategic management👉 Strategic management is the process of planning, implementing, and evaluating. techniques. Patent portfolios are now viewed not just as collections of legal rights, but as dynamic strategic assets that must be actively managed and optimized.

Looking ahead, patent portfolio management is likely to become even more data-driven and integrated with overall business strategy. Artificial intelligence and machine learning will play a growing role in portfolio analysis and optimization. There will also likely be greater emphasis on aligning patent portfolios with sustainability goals and responsible innovation👉 Practical application of new ideas to create value. practices.

As the pace of technological change continues to accelerate, effective patent portfolio management will remain crucial for companies seeking to protect their innovations and create lasting competitive advantage. The field will continue to evolve, building on its foundations in business portfolio analysis while leveraging new technologies and strategic insights.

The Evolution of Patent Portfolios from Business Portfolio Analysis

Patent portfolio management has become an essential strategic tool for technology-driven companies in recent decades. However, the concept of patent portfolios and their strategic management did not emerge in isolation. Rather, it evolved from broader business portfolio analysis techniques that were developed in the 1960s and 1970s. This article traces the development of patent portfolios from their roots in business portfolio analysis to their current role as a key element of intellectual property strategy.

Origins in Business Portfolio Analysis

The origins of patent portfolio management can be traced back to the emergence of business portfolio analysis in the 1960s. During this period, large diversified corporations were grappling with how to manage their various business units and product lines strategically. This led to the development of portfolio analysis techniques to evaluate and optimize a company’s mix of businesses.

One of the earliest and most influential portfolio analysis tools was the growth-share matrix developed by the Boston Consulting Group (BCG) in 1970. The BCG matrix plotted business units on a grid based on their market growth rate and relative market share. It categorized businesses into four quadrants:

- Stars: High growth and high market share

- Cash Cows: Low growth but high market share

- Question Marks: High growth but low market share

- Dogs: Low growth and low market share

This simple but powerful framework allowed executives to visualize their portfolio of businesses and make strategic decisions about resource allocation and investment. The BCG matrix became widely adopted and sparked the development of other portfolio analysis techniques.

In 1975, McKinsey & Company developed a more sophisticated nine-box matrix for General Electric that incorporated additional factors beyond just growth and market share. Other consultancies and academics proposed various portfolio models throughout the 1970s and 1980s.

The key principles underlying these business portfolio analysis techniques were:

- Visualizing the portfolio of business units or products graphically

- Evaluating units based on external market factors and internal company strengths

- Categorizing units into strategic groups

Using the analysis to guide resource allocation and investment decisions

These core concepts would later be applied to patent portfolios as companies began to view their intellectual property as strategic assets.

Early Patent Portfolio Management

As patents became increasingly important strategic assets for technology companies in the 1980s and 1990s, managers began to apply portfolio thinking to their patent holdings. However, early patent portfolio management was often rudimentary, focused primarily on quantity rather than quality or strategic alignment.

Many companies pursued a “numbers game” approach, seeking to amass large quantities of patents with the belief that more patents equaled greater protection and bargaining power. This led to significant growth in patent filings but also raised concerns about patent quality and the emergence of “patent thickets” that could stifle innovation.

Some pioneering companies and researchers began to develop more sophisticated approaches to patent portfolio management in the 1990s. For example:

- Dow Chemical implemented a system to classify its patents based on their strategic and financial value. This allowed Dow to focus resources on its most valuable patents while abandoning or selling off lower-value patents.

- Researchers like Ernst (1998) proposed frameworks for evaluating patent portfolios based on factors like technological relevance, legal strength, and economic value.

- Patent mapping techniques emerged to visualize relationships between patents and identify strategic gaps or opportunities in a company’s portfolio.

These early efforts laid the groundwork for more strategic patent portfolio management, but widespread adoption was still limited. Many companies continued to view patents primarily as legal instruments rather than strategic business assets.

Strategic Patent Portfolio Management Emerges

In the late 1990s and early 2000s, several factors converged to drive the emergence of more strategic approaches to patent portfolio management:

- The growing importance of intellectual property in the knowledge economy

- High-profile patent battles in industries like semiconductors and telecommunications

- The rise of patent assertion entities (“patent trolls”)

- Increased focus on intangible assets in corporate valuation

This led to greater executive attention on patent strategy and the application of portfolio management techniques from the business world to patents.

Key developments during this period included:

- The work of Rivette and Kline (2000) on “Rembrandts in the Attic,” which highlighted the untapped value in many companies’ patent portfolios.

- Growing adoption of patent analytics and visualization tools to gain insights from large patent datasets.

- Emergence of patent valuation methodologies to assess the economic value of patents and portfolios.

- Development of more sophisticated patent classification schemes beyond just technological categories.

- Application of options thinking to patent strategy, viewing patents as real options on future technology.

These advances enabled companies to take a more nuanced, strategic approach to managing their patent portfolios. Rather than just accumulating patents, firms began to shape their portfolios deliberately to align with business strategy and create competitive advantage.

Modern Patent Portfolio Analysis

Patent portfolio analysis has become an essential strategic tool for technology-driven companies in today’s knowledge economy. As intellectual property increasingly drives business value, organizations must take a sophisticated approach to managing their patent assets. Modern patent portfolio analysis combines business strategy, legal expertise, data analytics, and technology forecasting to optimize the value and strategic impact of a company’s patent holdings. By leveraging advanced analytical techniques and cross-functional collaboration, companies can align their patent portfolios with overall business objectives and gain competitive advantage.

Strategic alignment: Ensuring the patent portfolio supports overall business and technology strategy.

Strategic alignment is crucial for maximizing the value of a patent portfolio. This involves mapping patents to key products, technologies, and markets. It requires ongoing communication between IP, R&D, and business units. Patents should be evaluated based on their relevance to current and future business goals. Regular portfolio reviews help identify patents that no longer align with strategy.

Qualitative and quantitative analysis: Combining expert assessment with data-driven analytics to evaluate patents.

Effective patent analysis requires both qualitative expert judgment and quantitative data analytics. Expert patent attorneys and technologists provide critical insights on patent strength and relevance. Data-driven approaches like citation analysis and text mining reveal patterns across large portfolios. Combining human expertise with big data analytics yields the most comprehensive patent evaluations. This multi-faceted approach helps identify the most valuable patents.

Multi-factor evaluation: Assessing patents on dimensions like technical relevance, legal strength, economic value, and strategic importance.

Multi-factor evaluation provides a holistic view of a patent’s overall value and importance. Technical relevance considers how central the patent is to key technologies and products. Legal strength examines claim scope, prior art, and enforceability. Economic value assesses potential licensing revenue or cost savings. Strategic importance weighs factors like blocking competitors or enabling partnerships. Considering multiple dimensions ensures patents are evaluated comprehensively.

Competitive intelligence: Analyzing competitor patent portfolios to identify threats and opportunities.

Competitive patent intelligence is critical for understanding the IP landscape. It involves mapping competitor patent holdings in key technology areas. This reveals potential infringement👉 Unauthorized use or exploitation of IP rights. risks and licensing opportunities. Tracking competitor filing trends can provide early warning of new technology directions. Comparative analysis shows relative strengths and weaknesses of patent portfolios. This intelligence informs both defensive and offensive IP strategies.

Gap analysis: Identifying areas where patent protection is lacking and needs to be strengthened.

Gap analysis pinpoints vulnerabilities in a company’s patent coverage. It compares the current portfolio against key products, technologies, and markets. This reveals areas with insufficient patent protection. Gap analysis considers both the quantity and quality of patents in each area. It helps prioritize new patent filings and potential acquisitions to fill strategic gaps.

Scenario planning: Evaluating how the portfolio may need to evolve under different future scenarios.

Scenario planning prepares the patent portfolio for an uncertain future. It involves developing multiple plausible scenarios for technology and market evolution. The portfolio is then evaluated against each scenario to identify potential strengths and weaknesses. This highlights areas where the portfolio may need to adapt. Scenario planning ensures the patent strategy remains robust and flexible.

Dynamic management: Continuously optimizing the portfolio through selective filing, pruning, licensing, and transactions.

Dynamic portfolio management treats patents as actively managed assets. It involves ongoing evaluation and optimization of the portfolio. Low-value patents are pruned to reduce costs and focus resources. High-potential patents are strengthened through continuations and foreign filings. Licensing and sales monetize under-utilized patents. Strategic acquisitions fill gaps in the portfolio. This active approach maximizes portfolio value over time.

Cross-functional collaboration: Involving R&D, legal, strategy, and business units in portfolio decisions.

Effective patent portfolio management requires input from multiple functions. R&D provides insights on technology trends and innovation pipelines. Legal assesses patent strength and enforcement potential. Strategy aligns patents with business goals and competitive positioning. Business units offer market and product perspectives. Regular cross-functional reviews ensure holistic portfolio decisions. This collaborative approach optimizes the strategic impact of the patent portfolio.

Advanced patent portfolio analysis techniques

Patent portfolio analysis has evolved into a sophisticated discipline combining business strategy, intellectual property law, data analytics, and technology forecasting. Modern approaches leverage advanced techniques to gain deep insights from patent data and optimize portfolio value. By employing cutting-edge analytical methods, companies can make data-driven decisions about patent strategy and align their intellectual property assets with overall business objectives. The following techniques represent some of the most powerful tools available for strategic patent portfolio management:

Patent landscaping: Visualizing technological and competitive landscapes through patent data.

Patent landscaping creates visual representations of patent activity in specific technology areas. It allows companies to identify white spaces for innovation, track competitor activities, and spot emerging trends. Landscaping can reveal clustering of patent filings around certain technologies or companies. It provides a high-level view of the competitive and technological environment to inform R&D and patenting strategies.

Semantic analysis: Using natural language processing to extract insights from patent text.

Semantic analysis applies natural language processing techniques to patent documents. It can identify key concepts, technology classifications, and relationships between patents. Semantic analysis enables automated categorization of large patent datasets. It can uncover hidden connections between seemingly unrelated patents and technologies. This technique allows for more nuanced and comprehensive patent searches and analyses.

Network analysis: Mapping relationships between patents, inventors, and organizations.

Network analysis visualizes connections between different entities in the patent ecosystem. It can reveal collaboration networks between inventors or organizations. Network analysis identifies key influencers and central patents in technology domains. It allows companies to track knowledge flows and spot potential acquisition or partnership targets. This technique provides insights into the social and organizational dynamics of innovation.

Machine learning: Applying AI techniques to classify patents and predict future trends.

Machine learning algorithms can be trained on patent data to automate various analysis tasks. It can be used for patent classification, valuation, and quality assessment at scale. Machine learning enables predictive analytics to forecast future technology trends. It can identify patterns and anomalies in patent data that humans might miss. This technique is particularly powerful for analyzing very large patent portfolios.

Economic modeling: Quantifying the financial impact and value of patent portfolios.

Economic modeling applies financial and statistical techniques to estimate patent values. It can quantify the economic impact of patents on company performance and market value. Economic modeling enables portfolio-level valuation and helps optimize resource allocation. It can be used to assess licensing potential and set royalty rates. This technique provides a rigorous framework for measuring return on investment in patenting activities.

Modern Patent Portfolio Analysis

Patent portfolio analysis has evolved into a sophisticated discipline combining business strategy, intellectual property law, data analytics, and technology forecasting. Modern approaches leverage advanced techniques to gain deep insights from patent data and optimize portfolio value. The following steps outline a comprehensive process for conducting a value and quality based patent portfolio analysis:

- Portfolio Audit and Inventory: Create a comprehensive list of all patents in the portfolio. Categorize patents by technology domain, product line, business unit, etc. Record status of each patent (pending, granted, expired) and jurisdictions covered. Use AI/ML tools to automate categorization and sorting of large portfolios.

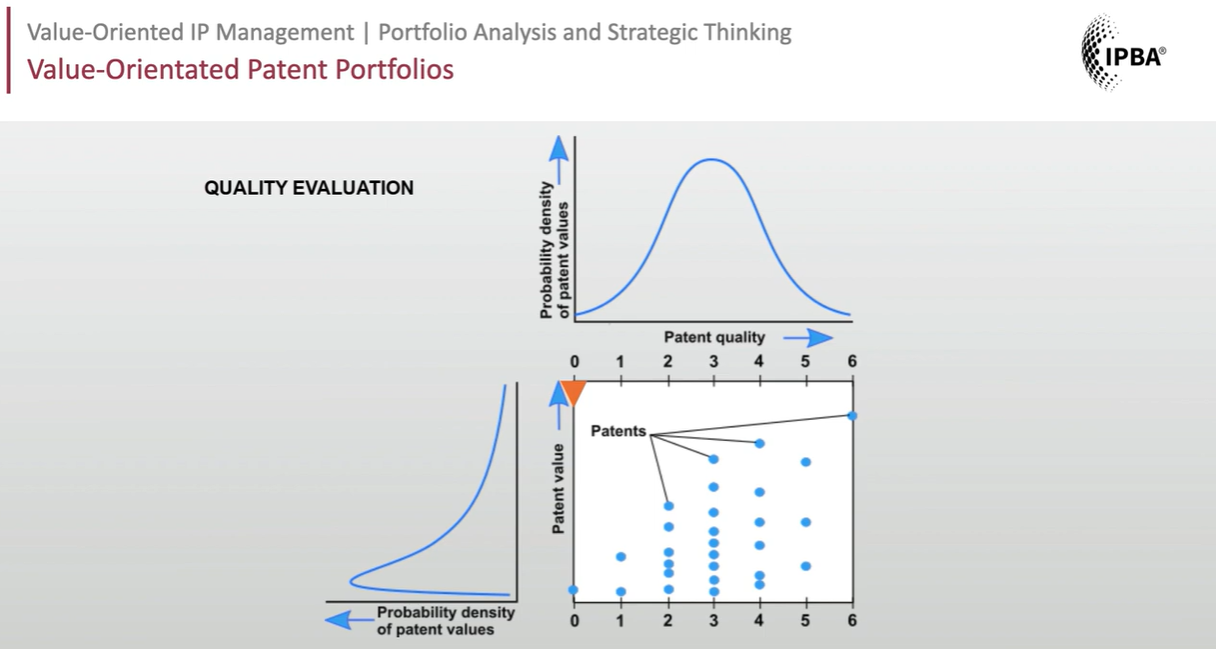

- Quality Assessment: Evaluate technical strength and innovation level of each patent. Assess legal strength, claim scope, and enforceability. Determine breadth vs depth of patent coverage. Use AI-driven tools to analyze patent text and claims for quality indicators.

- Market and Commercial Relevance Analysis: Analyze alignment with current and future business objectives. Evaluate geographical market coverage. Conduct competitor analysis to identify blocking or overlapping patents. Use predictive analytics to forecast future value and relevance of patents.

- Valuation: Estimate revenue potential from licensing, royalties etc. Perform cost-benefit analysis of maintaining vs abandoning patents. Consider market trends and how they impact patent value👉 Economic benefit derived from a patent's use.. Use AI valuation models that incorporate multiple factors.

- Strategic Opportunity Identification: Identify patents suitable for licensing or monetization. Determine patents that could be enforced against infringers. Evaluate potential for patent acquisitions or divestments. Use AI to uncover hidden opportunities in the portfolio.

- Risk Management👉 Process of identifying, assessing, and controlling threats to assets and objectives.: Risk👉 The probability of adverse outcomes due to uncertainty in future events. management involves identifying patents at risk of litigation or challenges from competitors. It requires evaluating patents for technological obsolescence to determine if they still provide value. Predictive models are used to forecast future risks to the patent portfolio. This proactive approach allows companies to mitigate potential threats before they materialize.

- Competitive Benchmarking: Competitive benchmarking compares a company’s patent portfolio against competitors and industry leaders to assess relative strengths and weaknesses. It helps identify technology gaps in the portfolio that may need to be filled through R&D or acquisitions. Patent landscaping tools are used to visualize the competitive position across different technology areas. This analysis provides strategic insights to guide portfolio development and competitive strategy.

- Portfolio Optimization: Portfolio optimization involves developing recommendations for pruning low-value patents to reduce maintenance costs. It identifies areas to strengthen through new filings or acquisitions to build strategic value. Strategies are created to maximize the value of high-potential patents through licensing or litigation. Optimization algorithms are used to model different portfolio scenarios and determine the optimal composition.

- Ongoing Monitoring and Management: Ongoing monitoring and management implements regular review cycles, such as annual portfolio audits. Real-time monitoring tools are used to track changes in the patent landscape and competitive environment. The portfolio strategy is continuously refined based on new data and insights. This ensures the portfolio remains aligned with business objectives as market conditions evolve.

- Reporting and Visualization: Reporting and visualization creates interactive dashboards to display key portfolio metrics and trends. Reports are generated for different stakeholders, including executives, R&D teams, and legal departments. Data visualization tools are used to effectively communicate insights and recommendations. This enables data-driven decision making👉 The process of choosing the best option among alternatives. across the organization regarding patent strategy.