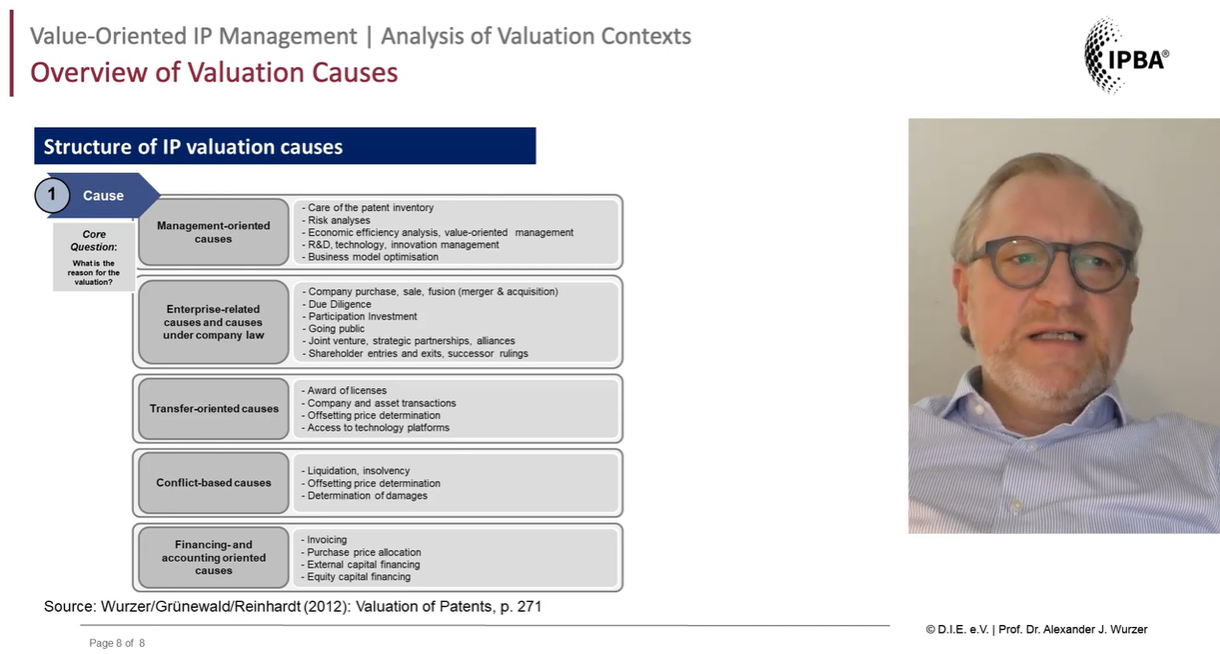

Intellectual property (IP) valuation has become increasingly important in today’s knowledge-based economy, where intangible assets often constitute a significant portion of a company’s value. There are numerous compelling reasons why businesses, investors, and other stakeholders should consider valuing their intellectual property assets.

The reasons for valuing intellectual property are diverse and span across various aspects of business operations, strategy, and legal compliance. As the global economy continues to shift towards knowledge-based industries, the importance of accurately valuing IP assets is only likely to increase. Whether for internal management purposes, external transactions, legal proceedings, or regulatory compliance, IP valuation provides crucial insights that support informed decision-making and help maximize the value of intangible assets. Companies that prioritize understanding and accurately valuing their IP are better positioned to leverage these assets for competitive advantage, financial gain, and long-term success in an increasingly complex and innovation-driven business environment.

This summary explores the key motivations and contexts for IP valuation.

Management-Oriented Reasons

Intellectual property (IP) valuation is a critical process for businesses to effectively manage and leverage their intangible assets. Management-oriented reasons for IP valuation encompass a range of strategic objectives that help companies make informed decisions, optimize their portfolios, and maximize value creation. The following list outlines key management-oriented reasons for conducting IP valuations, highlighting their importance in various aspects of business operations and strategic planning.

IP Portfolio Management

One of the primary reasons to valuate IP is for effective portfolio management. Companies need to assess the value of their IP assets to make informed decisions about patent filing, internationalization, and maintenance. IP valuation helps in conducting cost-benefit analyses and supports strategic decisions regarding investments in and divestitures of intellectual property. It also aids in determining appropriate remuneration for employee inventions.

Risk Analysis

IP valuation plays a crucial role in risk management. It helps companies assess potential risks associated with IP infringements, both in terms of defending their own IP and avoiding infringement of others’ rights. Valuations can provide insights into potential damages in case of infringement scenarios, supporting both proactive risk mitigation strategies and reactive damage assessments.

Economic Analysis and Value-Oriented Management

Valuing IP assets allows companies to conduct thorough economic analyses of their products, processes, and strategic departments. It helps in understanding the cost-benefit situation of various IP-related activities and assessing their contribution to overall company value. This information is vital for value-oriented management, where the goal is to maximize the contribution of each asset to the company’s success.

R&D, Technology, and Innovation Management

IP valuation is essential for evaluating the success of innovation efforts. It helps in assessing the economic viability of R&D projects and supports decision-making in technology management. By understanding the value of their IP, companies can better align their innovation strategies with market opportunities and competitive landscapes.

Business Model Optimization

Valuing IP assets is crucial for optimizing business models. It helps companies understand how their IP integrates into their value creation process and supports decisions about leveraging IP through various business strategies, such as licensing, partnerships, or direct commercialization.

Enterprise-Related and Company Law Reasons

In the realm of corporate transactions and strategic business decisions, intellectual property (IP) valuation plays a crucial role. Enterprise-related and company law reasons for IP valuation encompass a wide range of scenarios where accurate assessment of intangible assets is essential for informed decision-making, fair negotiations, and legal compliance. From investments and mergers to public offerings and partnerships, IP valuation provides critical insights into a company’s true worth and potential.

Participation Investment

IP valuation is crucial when companies consider investing in other entities, especially when IP assets form a significant part of the investment. It provides an accurate assessment of the value of contributions, ensuring fair and informed investment decisions. This valuation helps in determining the appropriate stake or ownership percentage in the invested entity based on the IP’s worth.

Mergers & Acquisitions (M&A)

In M&A transactions, IP valuation plays a critical role in determining the true value of the companies involved, particularly for technology-driven enterprises. It ensures that the deal-making process is fair and based on accurate assessments of intangible assets. IP valuation in M&A contexts helps both buyers and sellers understand the full potential and risks associated with the intellectual property portfolio being transferred.

Due Diligence

IP valuation is a key component of due diligence processes, providing potential investors or acquirers with crucial insights into a company’s IP portfolio. It helps in understanding both the value and risks associated with the IP assets, informing investment decisions and negotiation strategies. This valuation process can uncover hidden value or potential liabilities in IP assets that might not be apparent from financial statements alone.

Initial Public Offering (IPO)

When preparing for an IPO, valuing IP assets is essential for providing a comprehensive picture of a company’s worth to potential investors. This is particularly critical for technology and innovation-driven companies where IP forms a significant part of their value proposition. Accurate IP valuation in IPO contexts can significantly impact the company’s market valuation and the success of the public offering.

Strategic Partnerships and Alliances

IP valuation supports the formation and management of strategic partnerships and alliances by helping determine the value of IP contributions from each partner. It ensures fair terms in collaborative ventures and helps in structuring equitable agreements based on the value each party brings to the partnership. This valuation process can also guide the allocation of rights and responsibilities within the partnership or alliance.

Joint Ventures

In the formation of joint ventures, especially those involving technology partners, IP valuation is essential for determining the value of contributions from each party. It helps in structuring the venture equitably, ensuring that each partner’s contribution is fairly recognized and valued. IP valuation in joint ventures also aids in setting clear expectations and guidelines for the use and development of intellectual property within the new entity.

Partner Entry/Exit and Succession Planning

Valuing IP is crucial in scenarios involving changes in company ownership or structure, such as when partners join or leave a business or during succession planning. It ensures fair valuation of the company and appropriate distribution of assets, preventing potential disputes over the worth of intangible assets. This valuation process is particularly important in knowledge-based industries where IP can be the most valuable asset in ownership transitions.

Transfer-Oriented Reasons

Transfer-oriented reasons for intellectual property (IP) valuation are critical in scenarios where IP assets are being exchanged, licensed, or transferred between parties. These valuations ensure fair and accurate pricing in transactions, support strategic decision-making, and help maintain compliance with regulatory requirements. The following list outlines key transfer-oriented reasons for IP valuation, each playing a vital role in different types of IP transactions and transfers.

Licensing (In/Out) and Technology Transfer

IP valuation is crucial for determining fair terms in licensing agreements, benefiting both licensors and licensees. It helps establish appropriate royalty rates and other financial considerations based on the IP’s market value and potential. Accurate valuation in technology transfer ensures that the full worth of the technology is recognized, facilitating equitable transactions between parties.

Enterprise and Asset Transactions

In corporate transactions involving IP assets, valuation ensures that intangible assets are properly accounted for in the deal price. It helps both buyers and sellers understand the true value of the IP being transferred as part of the transaction. Accurate IP valuation can significantly impact the overall transaction value and terms of the deal.

Transfer Pricing

For multinational corporations, IP valuation is essential in establishing fair transfer prices for intangible assets moved between jurisdictions. It helps ensure compliance with tax regulations and international transfer pricing standards. Proper valuation can prevent disputes with tax authorities and mitigate risks of double taxation or tax evasion allegations.

Access to Technology Platforms

Valuing IP is critical when negotiating access to or contributing technology to platforms. It helps determine fair terms for participation, including entry fees, royalties, or equity stakes in platform-based collaborations. Accurate valuation ensures that all parties receive appropriate benefits and recognition for their IP contributions to the platform.

Conflict-Oriented Reasons

Conflict-oriented reasons for intellectual property (IP) valuation arise in situations where disputes or legal proceedings necessitate an objective assessment of IP assets. These valuations are often non-voluntary and conducted for external third parties, requiring a high degree of objectivity and impartiality. The following list outlines key conflict-oriented reasons for IP valuation, each playing a critical role in resolving disputes and ensuring fair outcomes in various legal and financial scenarios.

Liquidation and Insolvency

IP valuation is crucial in business liquidation or insolvency proceedings to accurately determine the value of a company’s intangible assets. It ensures that creditors receive fair treatment based on the true worth of the company’s IP portfolio. This valuation process helps maximize the recovery value from IP assets, potentially benefiting both the insolvent company and its creditors.

Infringement and Damage Calculations

When IP rights are infringed, valuation is essential for quantifying economic damages and determining appropriate compensation. It provides a basis for legal claims by assessing the financial impact of the infringement on the IP owner. The valuation process in infringement cases often involves complex analyses of lost profits, reasonable royalties, and potential future damages.

Financing- and Accounting-Oriented Reasons

Financing- and accounting-oriented reasons for intellectual property (IP) valuation are crucial for ensuring accurate financial reporting, tax compliance, and leveraging IP assets for financial purposes. These valuations play a significant role in providing stakeholders with a true picture of a company’s worth, optimizing tax strategies, and unlocking the financial potential of intangible assets. The following list outlines key financing- and accounting-oriented reasons for IP valuation, each serving a distinct purpose in financial management and reporting.

Financial Reporting

Accurate valuation of IP assets is essential for complying with various accounting standards and providing a true representation of a company’s value in financial statements. This process ensures transparency for investors and stakeholders, allowing them to make informed decisions based on a comprehensive view of the company’s assets. Regular valuation of IP for financial reporting purposes also helps companies track the changing value of their intangible assets over time, reflecting the dynamic nature of IP in the business environment.

Taxation

IP valuation plays a crucial role in various tax-related scenarios, helping companies optimize their tax strategies and comply with tax regulations. It is particularly important for determining the tax basis of intangible assets, which affects depreciation calculations and potential tax deductions. Accurate IP valuation also supports the calculation of capital gains taxes on IP transfers and can be instrumental in developing effective tax planning strategies that leverage the value of intellectual property assets.

Collateralization

As the recognition of IP as a valuable asset grows, companies are increasingly using their intellectual property as collateral for loans and other forms of financing. Accurate valuation of IP assets is critical in this context, as it directly influences the amount of financing that can be secured against these intangible assets. This practice opens up new avenues for companies to access capital, particularly for knowledge-based and technology-driven businesses where IP may represent a significant portion of their asset base.

Strategic Decision-Making

Intellectual property (IP) valuation plays a crucial role in strategic decision-making, providing companies with essential insights to guide their business strategies and resource allocation. By accurately assessing the value of their IP assets, organizations can make informed choices about investments, competitive positioning, and long-term growth opportunities. The following list outlines key strategic decision-making reasons for IP valuation, each highlighting how valuation informs critical business decisions.

Investment Decisions

IP valuation is instrumental in guiding resource allocation and investment choices within a company. It helps prioritize which technologies, brands, or innovations deserve further development and financial backing. By quantifying the potential value of different IP assets, companies can make data-driven decisions about where to focus their R&D budgets and innovation efforts.

Competitive Analysis

Valuing IP assets provides crucial insights into a company’s competitive position within its industry. It allows organizations to benchmark their IP portfolio against competitors, identifying strengths, weaknesses, and potential areas for improvement. This analysis can inform strategic decisions about market positioning, product development, and potential areas for collaboration or acquisition to strengthen the company’s competitive advantage.

Risk Management and Protection

Effective risk management and protection of intellectual property (IP) assets are crucial for companies to safeguard their innovations and maintain competitive advantage. IP valuation plays a pivotal role in this process, providing essential insights for insurance coverage and legal strategies. The following list outlines key aspects of how IP valuation contributes to risk management and protection, highlighting its importance in securing and defending valuable intangible assets.

Insurance

IP valuation is essential for obtaining appropriate insurance coverage for intellectual property assets. It helps companies accurately determine the level of protection needed, ensuring they are neither under-insured nor over-insured. In the event of IP-related losses, a well-documented valuation can support insurance claims, facilitating a smoother and more favorable claims process.

Legal Strategy

Understanding the value of IP assets is crucial in formulating effective legal strategies for protection and enforcement. It allows companies to prioritize their most valuable IP assets, allocating resources for stronger protection and more vigorous enforcement. This valuation-informed approach guides decisions about pursuing infringement cases, helping companies weigh the potential benefits against the costs of legal action.

Regulatory Compliance

Regulatory compliance in intellectual property (IP) valuation is crucial for ensuring transparency, meeting legal requirements, and maintaining stakeholder trust. As intangible assets become increasingly significant in corporate valuations, regulatory bodies have implemented stringent standards for IP reporting and disclosure. The following list outlines key aspects of regulatory compliance in IP valuation, highlighting its importance in financial reporting and stakeholder communications.

Transparency for Stakeholders

Accurate valuation and reporting of IP assets is essential for providing transparency to shareholders and other stakeholders about a company’s true worth. This transparency helps investors make informed decisions by offering a comprehensive view of the company’s assets, including its often substantial intangible value. Regular and accurate IP valuations can also enhance a company’s credibility in the market, potentially improving its attractiveness to investors and partners.

Compliance with Accounting Standards

Many jurisdictions have implemented specific accounting standards that require companies to value and report their intangible assets, including IP. These standards ensure consistency and comparability in financial reporting across different companies and industries. Proper valuation and reporting of IP assets in accordance with these standards is not just a legal requirement but also a demonstration of good corporate governance and financial management practices.

Market Opportunities

Intellectual property (IP) valuation plays a crucial role in identifying and capitalizing on market opportunities. By accurately assessing the value of their IP assets, companies can uncover new avenues for growth, optimize their product development strategies, and maximize their return on investment. The following list outlines key market opportunities that can be realized through strategic IP valuation, highlighting how this process can drive business expansion and innovation.

Identifying New Revenue Streams

IP valuation can reveal untapped potential in a company’s intellectual assets, opening doors to new revenue opportunities. By understanding the true value of their IP, companies can explore licensing agreements, strategic partnerships, or entry into new markets that leverage their existing assets. This process can transform underutilized IP into significant sources of income, enhancing the company’s overall financial performance.

Product Development

Valuing IP assets provides crucial insights that can shape and refine product development strategies. By identifying which IP assets hold the highest potential value, companies can prioritize their R&D efforts and resource allocation more effectively. This strategic approach to product development, guided by IP valuation, can lead to more successful product launches and a stronger market position in key technological areas.